Content:

Capital and Revenue receipts

Capital and Revenue expenditure

Deferred Revenue expenditure

Learning Outcomes:

Meaning of the term Capital and Revenue

Difference between capital and revenue receipts and capital and revenue expenditure

Learning about deferred revenue expenditure

CBSE Class 10 Elements of Book-Keeping and Accountancy Unit 1: Capital and Revenue Notes

Capital and Revenue:

Capital and Revenue are important concepts and a distinction between them is absolutely essential to find out the true financial position of a business. Any error to differentiate between the two will result in profit and loss account showing incorrect profit or loss and the Balance sheet will not

reflect actual status of the business. Capital and Revenue items may be classified as follows:

1. Capital and Revenue receipts

2. Capital and Revenue expenditure

Capital and Revenue Receipts:

Capital Receipt is characterised by the fact that it is non-recurring in nature and mainly involves an obligation to return the money so received. Examples are:

1. Capital brought in by the promoters treated as liability of the business

2. Loans taken considered as liability of the business

5. Sale of fixed assets

4. Subsidies/grants

Revenue receipt does not involve an obligation to return the money and is earned in the normal course of business. They increase the income of the business. Examples are:

1. Amount received from sales of goods

2. Dividends/ interest on investment

3. Discount and commission received

4. Rent received

The following examples will illustrate the importance of correct treatment of capital and revenue items in accounting:

Example 1:

Revenue earned in a year ₹500000

Expenses incurred during the yr. ₹400000

Profit earned ₹100000

Scrutiny revealed that an amount of ₹10000 spent for repair of the machinery was treated as capital expenditure and added to machinery account instead of repairs account and shown in the Profit & Loss account as running expense for the period. So, the profit shown was incorrect. Actual profit was to be ₹100000 – ₹10000 = ₹90000.

Example 2:

Revenue in a year ₹400000

Expenses during the year ₹300000

Profit during the year ₹270000

Investigation showed that furniture amounting to ₹40000 purchased during the year was debited to purchase account while actually it should have been debited to furniture account as an asset or capital expenditure. So, excess purchase was shown and wrong amount of ₹270000 was shown as profit. The correct profit figure should have been ₹310000.

Thus, if any capital expenditure is shown as revenue expenditure (like purchase of furniture shown as purchase) it will result in understatement of profit as well as undervaluation of assets. Thus, the financial statements like Trading, Profit & loss and Balance sheet will not reflect true and fair assessment of the affairs of the business. This is important from the taxation point as well. So, it is absolutely essential to identify exact nature of items of transactions and treat them accordingly.

Capital and Revenue expenditure:

A very important distinction in accounting is between Capital and Revenue items. The distinction has important implications for the purpose of preparing the Trading, Profit & Loss Account and Balance Sheet. The revenue items form part of the Trading and Profit and Loss Account while the capital items help in the preparation of a Balance sheet.

Essential Aspects of Capital and Revenue expenditure:

1. Whenever payment and/or incurrence of an outlay are made for a purpose other than the settlement of an existing liability, it is called an expenditure. The expenditures are incurred with the viewpoint that they would give benefits to the company. Normally, the benefits of expenditure extend up to one accounting period or more than one year.

2. If the benefit of expenditure extends up to one accounting year it is termed as Revenue expenditure. Normally they are incurred for day-to-day conduct of the business. The salaries paid to the workers will benefit the company for the current accounting year only and not spill over to next year. This is an example of revenue expenditure. Other examples are wages, rent, taxes, insurance, depreciation, selling and distribution expenses, legal expenses etc.

If the benefit of expenditure goes beyond one year it will be termed as Capital expenditure. Example: Payment made to acquire furniture for use in the business.

Furniture acquired in the current accounting year will give benefits to the company for many accounting years to come. Usual examples of capital expenditure can be payment to acquire fixed assets like plant and machinery, land and building, cost of addition and alterations to fixed assets, cost of product development etc.

The distinction between capital expenditure and revenue expenditure is shown here under:

| Capital Expenditure | Revenue Expenditure |

| 1. Capital Expenditure increases earning capacity of the business. | 1. Revenue expenditure is incurred to maintain the earning capacity of the business. |

| 2. Capital Expenditure is incurred to acquire fixed assets to run operations of the business. | 2. Revenue expenditure is for day-to-day conduct of the business. |

| 3. Capital expenditure is non-recurring. | 3. Revenue expenditure is recurring in nature. |

| 4. The benefit of capital expenditure is spread over a number of years. | 4. The benefit generated by revenue is limited to one accounting year. |

| 5. Capital expenditure is subject to depreciation and recorded in Balance Sheet. | 5. Revenue expenditure is adjusted for prepaid or outstanding amount and is shown in Trading and Profit and Loss account. |

Expenditure and Expenses:

It should be understood that expenditure is a wider term and includes expenses. Expenditure is the total outlay made or incurred by a business unit. The part of the expenditure which is perceived to have been used or consumed in the current accounting year is termed expense for the current year. Expenses are running costs while a heavy expenditure, say on advertisement, is termed deferred revenue expenditure.

Deferred Revenue Expenditure:

As has already been said, if the benefit of an expenditure extends for more than one accounting year it is termed as capital expenditure, but sometimes it becomes difficult to classify the expenditure into revenue or capital category. For example, in normal usage, the advertising expenses are classified as revenue expenditure. But, when a heavy expenditure is incurred say, on an advertising campaign which would benefit a business for many years it is termed as deferred revenue expenditure. The cost of such expenditure is spread over a number of years. The treatment of deferred revenue expenditure is same as that of capital expenditure. They are also written-off over their expected period of benefit.

Illustrative examples:

| Transactions | Classification | Reasons |

| ₹1000 spent on repair of machine | Revenue Expenditure | Routine expense which does not add to the earning capacity. |

| ₹20000 spent on repair of a boiler | Capital Expenditure | The expenditure is increasing the value of an asset. |

| ₹1000 paid for erection of a machinery | Capital Expenditure | Amount spent was necessary to make the machinery ready for use. |

| ₹5000 spent for raising a loan | Capital Expenditure | Amount spent for long term benefit by raising funds. |

| ₹8000 spent for annual whitewashing charges | Revenue expenditure | Regularity of the expenditure makes it a revenue in nature. |

| Paid insurance premium ₹2000 | Revenue expenditure | Amount spent on regular basis, So it is revenue expenditure. |

| Old furniture purchase for ₹10000 | Capital Expenditure | It is a long-term investment. |

| Factory premises repaired at a cost of ₹5000 | Revenue Expenditure | Repair of factory premises required for maintaining production. |

| Cost of hiring a truck | Revenue Expenditure | Hiring of truck necessary for regular carriage of goods. |

| ₹50000 spent on ad campaign | Deferred Revenue Expenditure | The benefit of a large amount spent on advertising will be spread over coming years and cost of advertising will also be shared. |

| Purchase of Patent rights | Capital Expenditure | Purchase of patent rights is a long-term investment. |

| Installation of AC in the chamber of CEO | Capital Expenditure | Installation of the AC will bring in efficiency in the long run. |

| Sale of investment ₹20000 | Capital Receipt | The gain is from sale of asset and not through sale of goods. |

| Sale of old machine ₹15000 | Capital Receipt | The sale proceed is not through normal process of sale of goods but through sale of capital goods. |

| A grant of ₹20000 received for installing solar panel | Capital Receipt | The grant is for installing capital infrastructure. |

| Machine valued at ₹40000 is sold for ₹30000 | Capital Loss | Loss incurred in sale of fixed Asset. |

| A debtor owing ₹ 25000 can only pay ₹₹20000 | Revenue Loss | The loss has been incurred in normal course of business. |

| Machine costing ₹40000 destroyed by fire | Capital loss | Destruction of fixed asset is a capital loss. |

Accounting treatment of Deferred Revenue Expenditure:

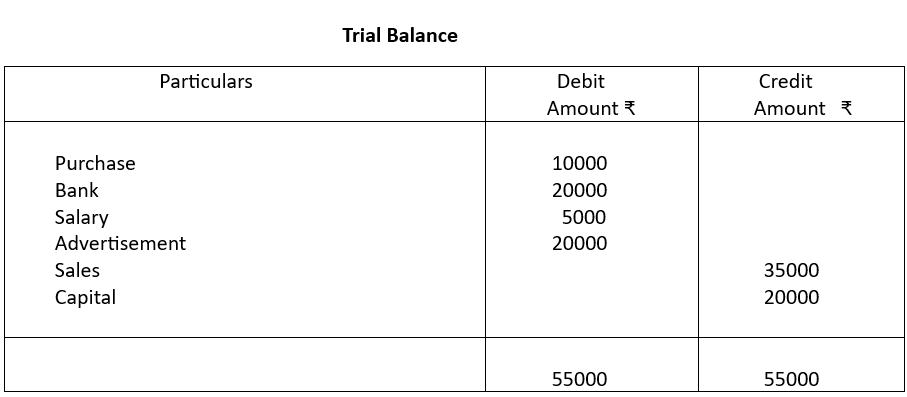

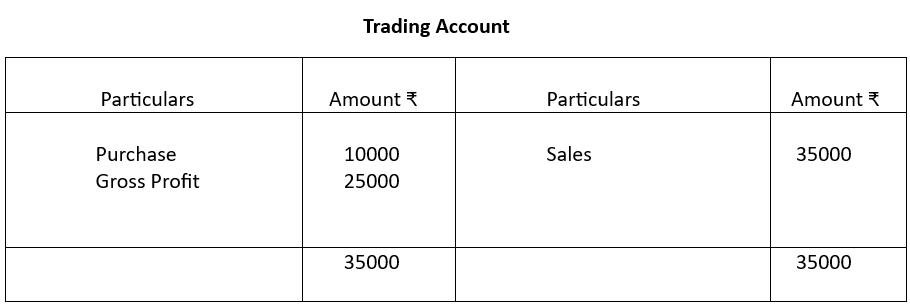

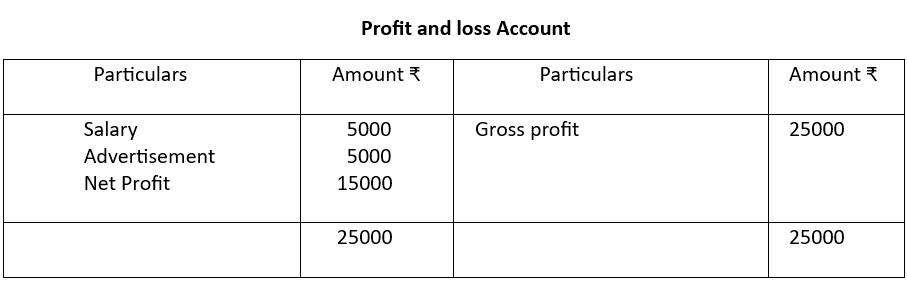

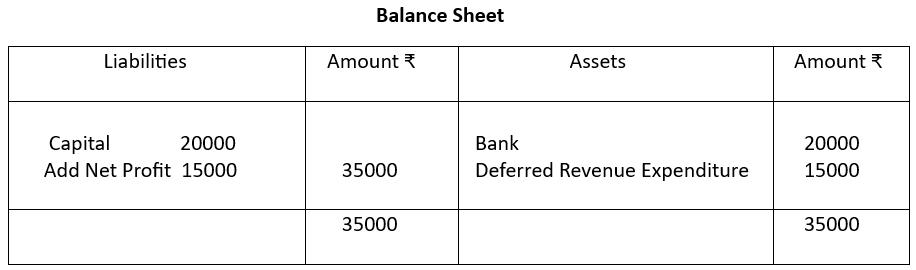

The cost of the expenditure is normally spread over 3-5 years. During each of the accounting years, part of the expenditure as allocated for the year is charged to Profit & Loss account and rest of the amount is shown as asset in Balance Sheet. The treatment is same as depreciation against fixed assets. Let us consider the following trial balance and prepare Trading account, Profit and loss account and

Balance Sheet:

It was decided to spread the advertisement cost of ₹20000 in four years as deferred revenue expenditure.

Explanatory note: It was decided to spread the total outlay of ₹20000 on advertisement in four years. Therefore, ₹5000 has been debited to profit and loss account in the 1st accounting year and the rest ₹15000 has been transferred to balance sheet as asset. This will go on until the entire amount is written off in four years.

CBSE Class 10 Elements of Book-Keeping and Accountancy Unit 1: Capital and Revenue – Completed

We have completed the following topics in this unit:

Content:

Capital and Revenue receipts

Capital and Revenue expenditure

Deferred Revenue expenditure

Learning Outcomes:

Meaning of the term Capital and Revenue

Difference between capital and revenue receipts and capital and revenue expenditure

Learning about deferred revenue expenditure

Related Links:

Unit 1: Capital and Revenue

Unit 2: Depreciation

Unit 3: Bank Reconciliation Statement

Unit 4: Bills of Exchange

Unit 5: Final Accounts

Unit 6: Accounting from Incomplete records

Test Paper 1

Test Paper 2