Content:

Need and methods of charging depreciation

Straight line method

Diminishing Balance method

Learning Outcomes:

Appreciating the necessity of providing depreciation on fixed assets

Developing the skill of using straight line method and diminishing balance method for computing depreciation

Preparing fixed assets accounting using straight line and diminishing balance methods of charging depreciation

CBSE Class 10 Elements of Book-Keeping and Accountancy Unit 2: Depreciation Notes

Definition of Depreciation:

One of the characteristics of fixed assets is that they tend to lose their usefulness and value over a certain length of time. This is due to obsolescence through technology development and market change. This decline is measured in terms of money. Depreciation may, thus be described as a permanent, continuing and gradual shrinkage in the book value of fixed assets and includes amortisation of assets whose useful life is predetermined.

Amortisation refers to writing off the cost of intangible assets like goodwill, copyright etc. which have utility for a specific period of time. Depreciation is charged against assets in each accounting period and has significant effect in determining and presenting the financial statements of Profit and Loss Account and Balance Sheet.

Characteristics:

1. It is a decline in the book value of fixed assets dueto effluxion of time, usage or obsolescence2. It is a continuous process

3. It has to be deducted before calculation of taxable profit

4. It is a non-cash expense

Need for Providing Depreciation on Fixed Assets

1. Matching the cost and revenue:

To earn revenue, any business has to invest in fixed assets. It is equally true that every asset is bound to undergo some wear and tear and hence lose value once it is put into use. Therefore, depreciation is as much a cost as any other expense like salary, rent, stationery etc. which are necessary for normal running of the business. It is a charge against the revenue of a particular year and must be deducted before arriving at net profit as per Generally Accepted Accounting Principles.

2. Compliance with Tax laws:

Depreciation is deductible cost for tax purpose. It reduces the tax liability of a concern. Apart from tax regulations, there are certain specific legislations that compel corporate enterprises to provide depreciation on fixed assets.

3. True and fair financial position:

If depreciation on assets is not provided for, the assets will be overvalued and Balance Sheet will not portray the correct financial position of a business. This is not permitted by established accounting practices.

4. Replacement of Asset:

Businesses need to replace assets like machinery at the end of their useful lives. Depreciation is allocating the cost of an asset over time.

Factors Affecting the Amount of Depreciation

1. Cost of Asset:

Cost, also known as original cost or historical cost, of an asset is the invoice price of the asset plus other charges which are necessary to put the asset in use or in working condition. Such incidental expenses to “ready” the asset include freight and transportation, transit insurance, installation

cost, registration cost, cost of software etc. In case of purchase of second-hand machinery, initial repair costs are also included.

Thus, according to ICAI cost of a fixed asset is the cost of its acquisition, installation and commissioning as well as that of addition and improvement of the depreciable asset. Let us consider an example:

Purchased a printer for ₹ 10000

Freight & installation ₹ 2000

Original cost of the printer ₹ 12000

Now, this cost will be written off as depreciation over the useful life of the printer at a specified rate per year.

2. Estimated Net residual Value:

Net residual value also known as scrap value or salvage value is the estimated realisable value of the asset at the end of its useful life. The net residual value is calculated after deducting expenses necessary for disposal of the asset. In the above example, if the estimated scrap value is ₹1000 and cost of disposal is ₹500. The net scrap value will be ₹500.

3. Depreciable Cost:

Depreciable cost of an asset is equal to its cost (as shown above) less net scrap/residual value. In terms of the above example, depreciable cost would be ₹12000 – ₹500 = ₹11500. This amount will be distributed and charged as depreciation over a period of time at an agreed percentage. It should be remembered that the total amount of depreciation charged over the useful life of the asset, in this case the printer, must be equal to depreciable cost of the asset. If the total amount of depreciation charged is less than the depreciable cost, it will violate the principle of proper matching of revenue and expense.

4. Estimated useful life of asset:

Useful life of an asset is the useful economic and commercial life of the asset. Physical existence is not considered a valid reason for the purpose of depreciation. The important factor is productivity and whether the asset is able to contribute to profitability of the business. Thus, a machine may remain in working condition after some years but its productivity may have gone down substantially ending its usefulness. Estimation of useful life is somewhat difficult and depends upon the following factors:

1. Predetermined leasehold policy limiting active use to specific number of years

2. In case of machinery, the number of shifts it is used

3. Technology obsolescence

4. Repair policy of the business and cost involved

Methods of calculation Depreciation Amount:

The depreciation amount to be charged against assets depend upon following parameters:

1. Cost of Asset

2. Estimated Net Residual Value

3. Depreciable Cost

4. Estimated Useful Life

Methods of allocation of Depreciation

Two allocation methods are mandated by law and widely used by professional accounting community:

1. Straight Line method for Computing Depreciation

2. Diminishing Balance method for Computing Depreciation

Other methods are annuity method, depreciation fund method, insurance policy method, double declining method but these are seldom used.

Straight Line Method for Computing Depreciation:

This is one of the widely used methods for providing depreciation. This method is based on the assumption of equal usage of asset over its entire useful life. It is called straight-line because if the amount of depreciation and corresponding time period is plotted on a graph, it will result in a straight line. It is calculated using the following formula:

Annual depreciation amount = (Cost of Asset – Net Residual value)/Estimated useful life of the asset

Rate of depreciation = (Annual depreciation amount/Acquisition cost) x 100

Example:

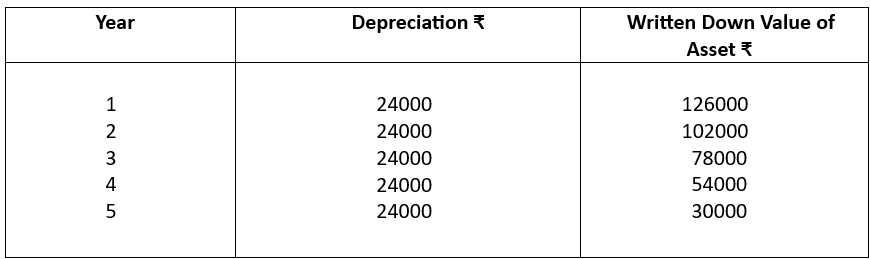

Acquisition cost of the asset = ₹ 150000

Useful life of the asset = 5 years

Residual value = ₹30000

Annual depreciation value will be: (₹150000 – ₹30000) / 5 = ₹24000

Rate of depreciation will be: (₹24000/₹150000) x 10 = 16%

The above example can be illustrated as follows:

Advantages of Straight Line Method:

a) It is a simple method, easy to understand and apply.

b) This method makes it possible to distribute full depreciable cost up to net scrap value or zero value.

c) As total depreciation charge remains the same every year, comparison of profitability is possible from year to year.

d) This method is more suitable for assets having consistent use like say, land & building.

Limitations of Straight Line Method:

a) This system assumes same usage pattern for an asset which is not a practical idea.

b) In the long run , maintenance and repair expenses keep on increasing. So, the same amount charged every year for depreciation and repairs on falling asset value adversely affects the financial position of the business.

Diminishing Balance method or Reducing Balance Method:

Under this method, depreciation is charged on the Book value of the asset. Book value of an asset is the asset value minus depreciation which is called the written down value. Under this method depreciation is calculated on the written down value at a predetermined percentage of book value or written down value of the asset at the beginning of the year. The mechanism implies that like asset book value and the amount of depreciation keeps reducing every year.

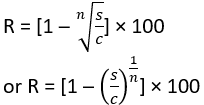

Formula:

The formula for calculating the percentage of depreciation under this method is:

where

R = Rate of depreciation

n = expected useful life

s = scrap value

c = cost of an asset

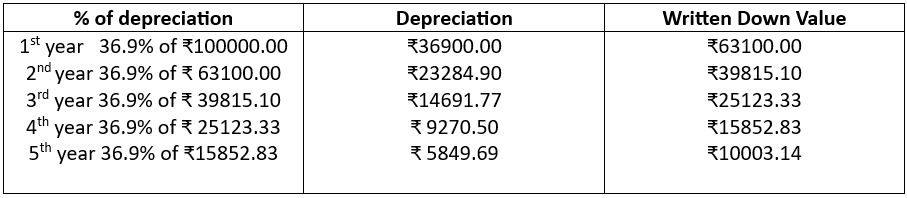

Example:

Original cost of an asset is ₹100000

Expected useful life is 5 years

Salvage value after 5 years is ₹10000

Computation of depreciation in Diminishing Balance method:

Depreciation to be charged in each of five years can as follows:

Advantages of Diminishing Balance method:

1. This method is based on more realistic assumption that the benefits from an asset go on diminishing (reducing) with the passage of time. Hence, it is logical that higher amount of depreciation should be allocated in the earlier years to take advantage of higher productivity and ensure proper costing. Thus, when in the following years asset utility is lower, corresponding depreciation cost will also be lower.

2. Under Diminishing Balance method, depreciation charge declines in later years. This compensates for the rising repair and maintenance charges and does not put extra burden on profitability.

3. Income tax authorities accept this method for tax purpose.

4. Since depreciation in the initial years is quite high and less in later years, the burden of the increasing cost of obsolescence is less in later years. So, the Diminishing Balance method is suitable for assets which have higher rate of obsolescence.

Limitations of Diminishing Balance method:

1. As depreciation is calculated at fixed percentage of written down value, depreciable cost of the asset cannot be fully written off. The value of asset can never be zero.

2. It is difficult to ascertain a suitable rate of depreciation as technical obsolescence of the asset can be a complicated matter.

Straight Line Method and Diminishing Balance method: A Comparison

| Points of difference | Straight Line Method | Diminishing Balance method |

| 1. Basis of charging depreciation | Original Cost of the asset | Book Value i.e. original cost less depreciation charged till date or net Book value at the beginning of the year |

| 2. Annual depreciation charge | Fixed every year | Declines year after year |

| 3. Total depreciation charge against profit & loss account | Increases in the later years with rising repair expenses | Almost equal every year as declining depreciation cost is balanced with rising repair expenses |

| 4. Depreciated Asset value | Under this method total asset value is reduced to scrap value or zero value | Under written down value method the book value of the asset can never become zero |

| 5. Tax laws | Not recognised by Income Tax authorities | Recognised by tax authorities |

| 6. Suitability | Suitable for assets requiring less repair cost and where possibility of obsolescence is low | Suitable for assets in which obsolescence/repair cost is high |

Preparing Fixed Assets Accounting Using Straight Line and Diminishing Balance Method of Charging Depreciation:

Depreciation on fixed assets can be provided in the books of account in two ways:

1. Charging depreciation to asset account

2. Creating provision for depreciation account

Charging Depreciation to asset account:

In this method depreciation is deducted from the depreciable cost of the asset (credited to asset account) and charged i.e. debited to Profit & Loss account. This is illustrated below:

a) Journal entry for recording purchase of an asset:

Asset A/c………………………dr.

To Bank/Vendor A/c

(Cost of asset plus installation, freight etc)

b) Following two entries are recorded at the end of the year for charging depreciation:

Depreciation A/c ………… dr

To Asset A/c

(depreciation provided on asset)

For charging depreciation to Profit & Loss A/c

Profit & Loss A/c …………….dr

To Depreciation A/c

(depreciation charged to profit & loss A/c)

Note: Depreciation account is closed by transferring the balance to profit and loss account.

c) Balance sheet treatment:

The amount of depreciation to be charged against a particular asset is deducted from the net asset value or book value appearing on the asset side of the Balance Sheet. Book value is the original cost of the asset minus depreciation charged till date and it keeps reducing year after year.

Creating Provision for Depreciation:

This method is designed to accumulate the depreciation provided on an asset in a separate account called Provision for Depreciation or Accumulated depreciation account. In this way the asset account is not touched and it continues to be shown at its original cost over successive years of its useful life. Two basic characteristics of this method are:

a) Asset account continues appear at its original cost year after year during its useful life

b) Depreciation is accumulated in a separate account instead of being adjusted in the asset account at the end of each accounting period

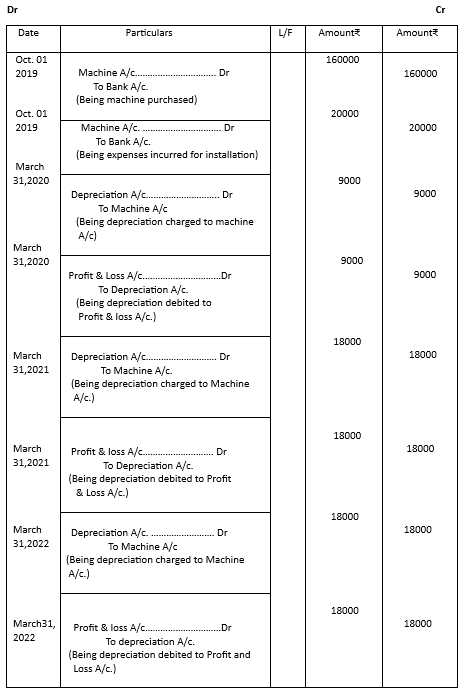

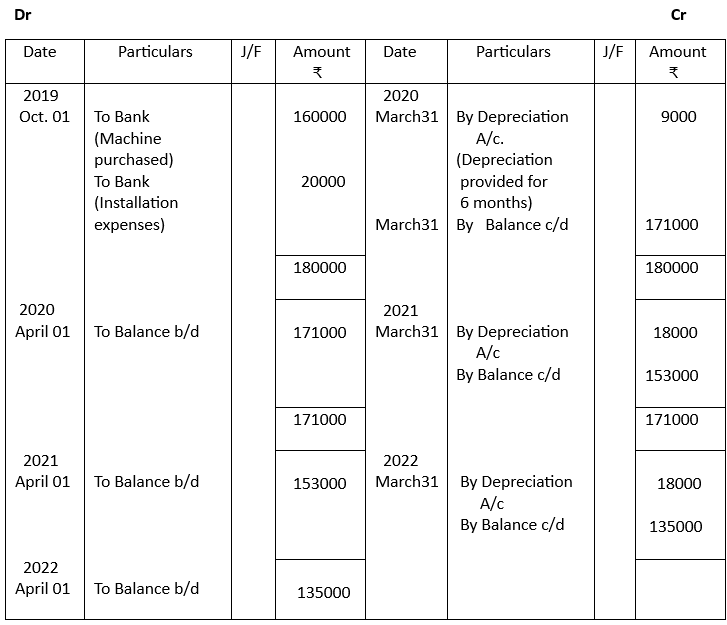

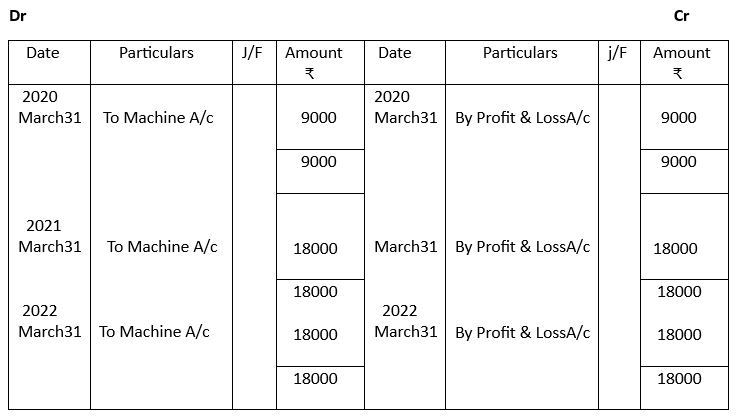

Example 1:

M/s. Goenka Bros. acquired a machine for ₹160000 on October 1, 2019 and spent ₹20000 on its installation. The firm writes off depreciation @10% p.a. on original cost every year. Record necessary journal entries and draw up Machine Account and Depreciation Account for the first three years assuming that the firm charges

a) depreciation on 31st March every year

b) depreciation is charged to asset account

Solution:

Books of Goenka Bros.

Journal

Books of Goenka Bros

Machine A/c.

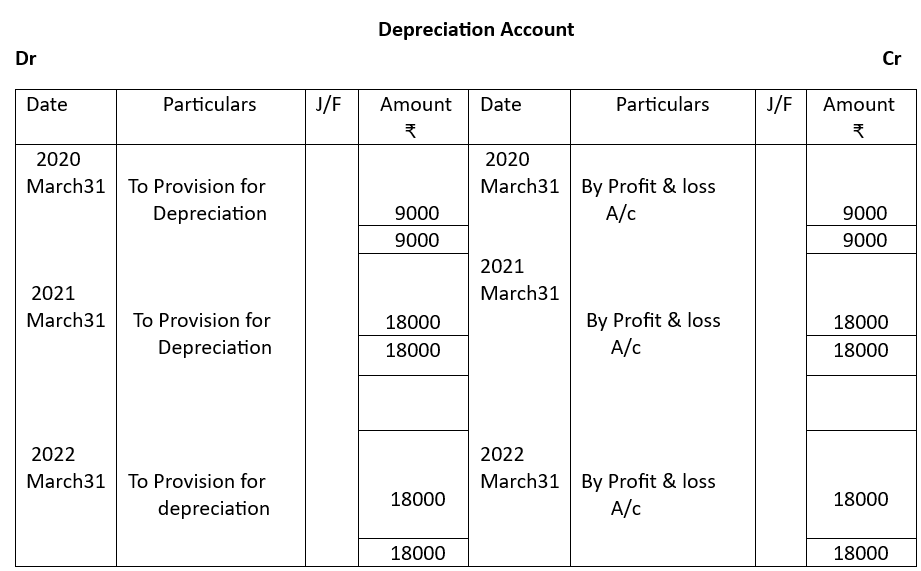

Depreciation Account

Working Notes:

1. Original cost of the machine = Purchase cost + cost of installation

= ₹160000 + ₹20000

= ₹180000

2. Depreciation expense/year = 10% of ₹180000

= ₹18000

3. During the year 2019 depreciation has been charged for 6 months as the machine was acquired

on 01.10.2019 and used for 6 months

4. Depreciation for 2019-20 = ₹18000 x 6/12

= ₹9000

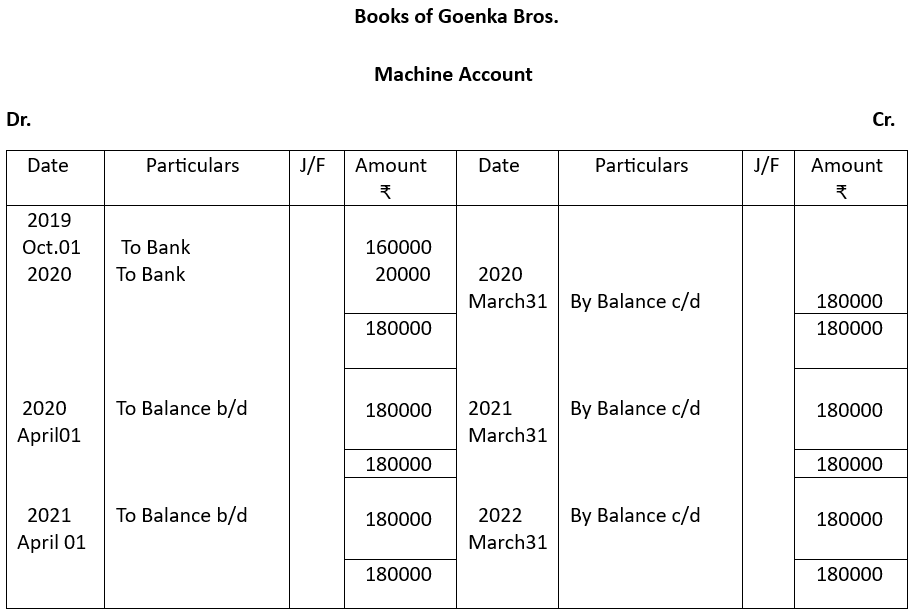

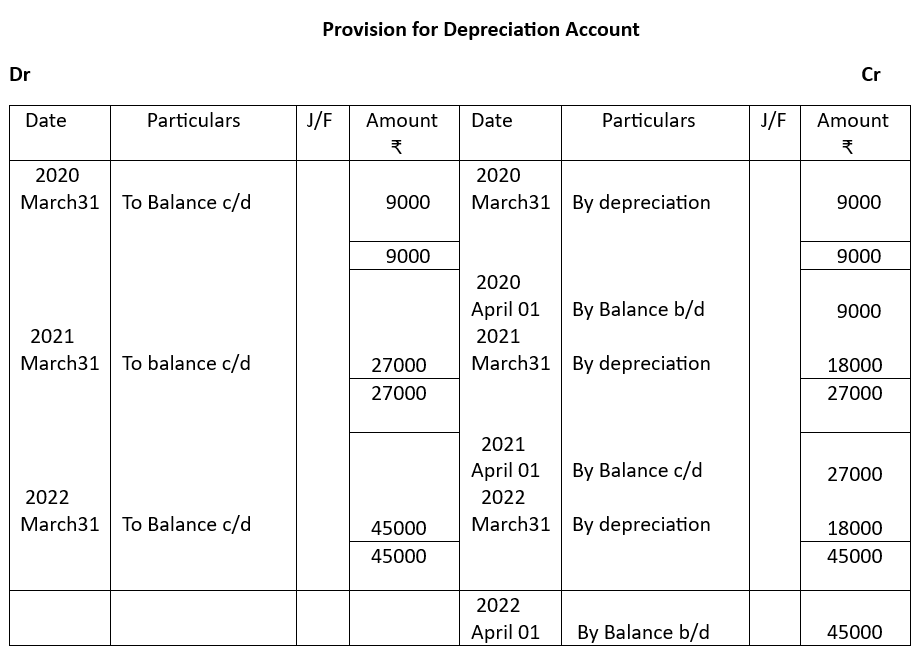

Example 2

Based on the data provided in Example 1, let us now construct Machine account, Provision for Depreciation Account and Depreciation Account for the first three years supposing that Provision for Depreciation account is maintained by the firm.

Solution:

Explanatory Notes:

1. Machinery A/c. (Asset A/c) continues to appear in its original cost year after year.

2. Depreciation is accumulated in a separate account called Provision for depreciation account instead of being adjusted in the asset account.

3. This Provision for Depreciation is either shown as liability in the Balance Sheet or deducted from the Asset value in the Asset side.

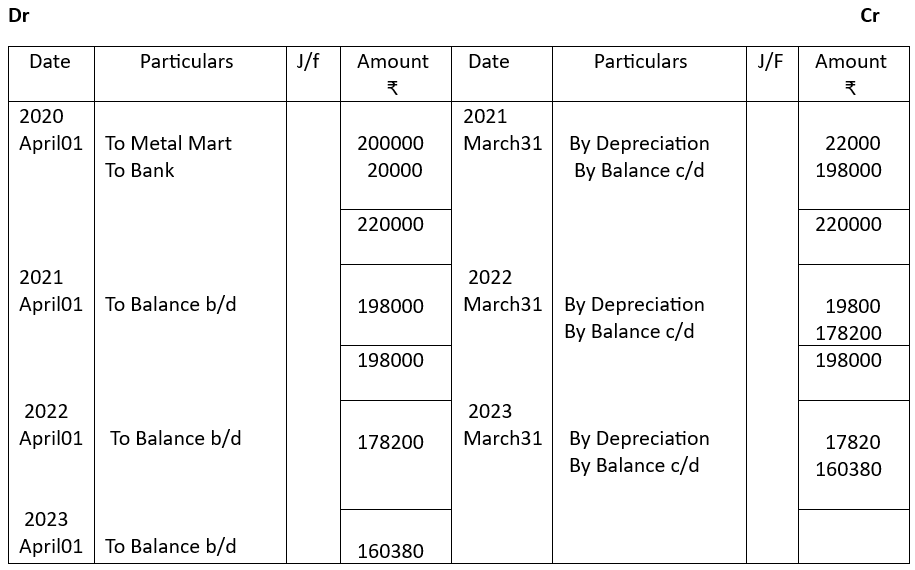

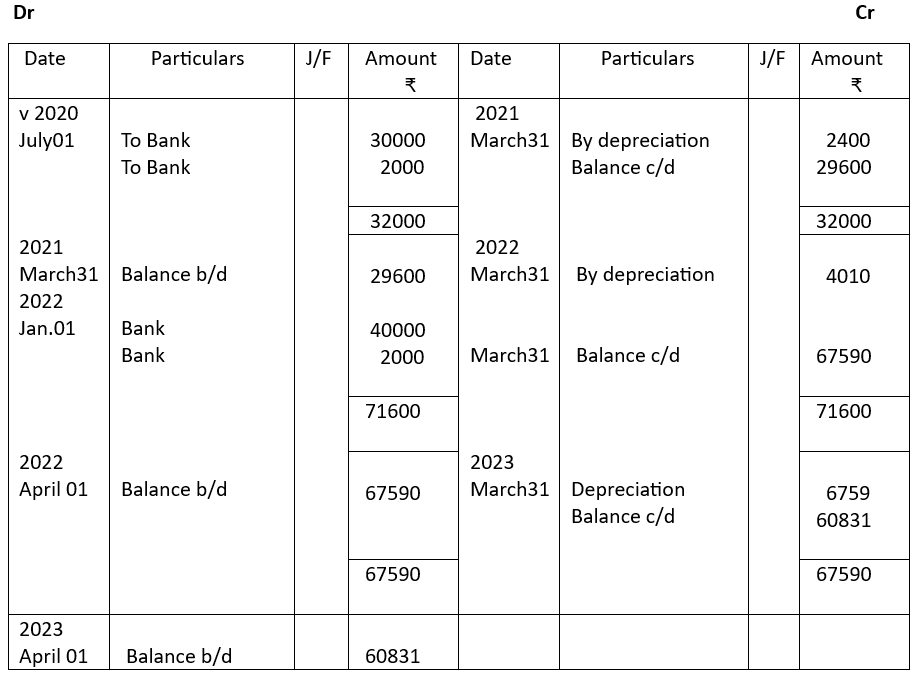

Example 3

M/s. Rajesh Oil Mills purchased machinery on April 01,2020 for ₹200000 on credit from M/s. Metal Mart and spent ₹20000 for its installation. Depreciation is provided @10% on Diminishing Balance method basis. Prepare Machinery A/c for three years assuming books are closed on 31st March every year.

In the Books of M/s. Rajesh Oil Mills

Machinery Account

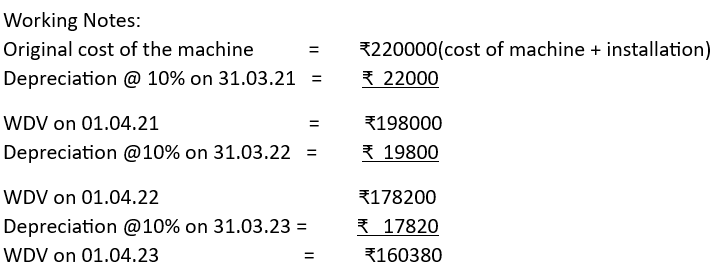

Example 4

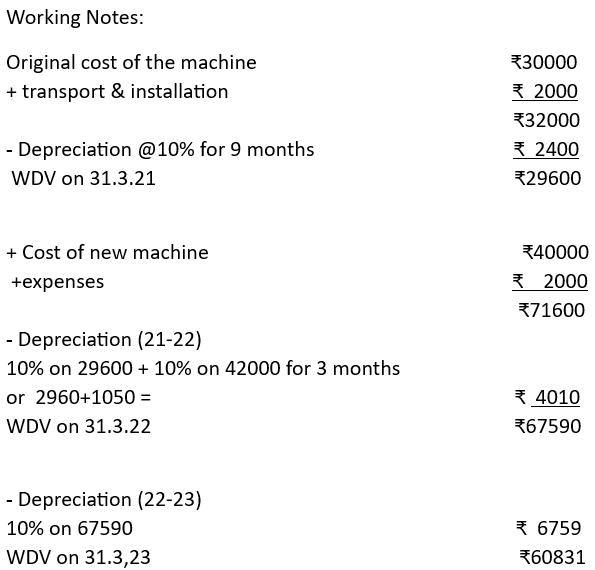

M/Nair enterprises purchased a leather stitching machine for ₹30000 on July 01, 2020 and spent ₹2000 for transport and installation. One more machine was acquired on January 01, 2022 for ₹40000 and expenses incurred ₹ 2000. Depreciation is charged @10% on Diminishing Balance method.

Prepare Machinery account.

Solution:

In the Books of Nair Enterprises

Machinery Account

CBSE Class 10 Elements of Book-Keeping and Accountancy Unit 2: Depreciation Notes – Completed

We have completed the following topics in this unit:

Content:

Need and methods of charging depreciation

Straight line method

Diminishing Balance method

Learning Outcomes:

Appreciating the necessity of providing depreciation on fixed assets

Developing the skill of using straight line method and diminishing balance method for computing depreciation

Preparing fixed assets accounting using straight line and diminishing balance methods of charging depreciation

Related Links:

Unit 1: Capital and Revenue

Unit 2: Depreciation

Unit 3: Bank Reconciliation Statement

Unit 4: Bills of Exchange

Unit 5: Final Accounts

Unit 6: Accounting from Incomplete records

Test Paper 1

Test Paper 2