Content:

Nature and use of Bill of Exchange

Terms used in Bills of Exchange

Simple transactions related to bills of exchange

Learning Outcomes:

Acquiring knowledge of using bills of exchange for financing business transactions

Understanding the need for bills of exchange in business

State the meaning of different terms used in bills of exchange and their implication in accounting

Develop the skill of journalising simple bill transactions in the books of debtor and creditor

CBSE Class 10 Elements of Book-Keeping and Accountancy Unit 4: Bills of Exchange

Nature of Bill of Exchange

The Negotiable Instrument Act 1881 says that a bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.

The emerging features of a bill of exchange are:

1. A bill of exchange must be in writing

2. It is an order to make payment

3. The order to make payment is unconditional

4. Maker of the bill of exchange must sign it

5. The payment to be made must be certain

6. The date on which the payment is to be made must be certain

7. The bill of exchange must be payable to a certain person

8. The amount can be paid either on demand or on the expiry of the fixed time

9. The instrument must be stamped as per the requirement of law

Use of Bills of exchange:

1. Instrument for business relationship: A bill of exchange is a device which provides a framework for credit transaction between the seller/creditor and buyer/debtor on an agreed basis.

2. Binding terms and conditions: The stipulated time of payment assures the creditor of the payment, so he can plan his activities accordingly. The debtor also knows the exact time of payment and this builds a healthy relationship between the two.

3. Easy access to credit: The bill of exchange enables the buyer to buy goods on credit and pay after the credit period. The creditor also can access easy credit by getting the bill discounted from a bank against nominal bank charges to manage his working capital. He might even endorse it in favour of third party to buy goods for his business.

Parties to a bill of exchange

A bill of exchange is generally drawn by the creditor (drawer) upon his debtor (drawee). There are three parties to a bill of exchange:

(1) Drawer or maker of the bill of exchange. A seller or creditor who is entitled to receive payment from a buyer(debtor) can draw a bill of exchange upon the buyer or debtor. The drawer will sign the instrument after writing it.

(2) Drawee is the person upon whom the bill of exchange in drawn. A drawee is a debtor who is supposed to pay for the goods he had purchased.

(3) Payee is the person to whom the payment is supposed to be made. The drawer of the bill will be the payee himself if he keeps the bill with him till the date of payment. Payee may be different in two circumstances:

(a) If the drawer got the bill discounted for immediate payment, then the third party will become payee.

(b) In case the bill is endorsed in favour of a creditor of the drawer, the creditor will become the payee.

Example:

Sanjay sold goods to Deepak for ₹10000 and drew a bill of exchange on him to be payable after three months. Here, Sanjay is the drawer and Deepak is the drawee.

If Sanjay retains the bill for three months, he becomes the payee. If Sanjay endorses (transfers) the bill to his creditor, say Amit then Amit will become the payee after three months. If Sanjay gets the bill discounted from a bank for early payment, then the bank becomes payee on maturity of the bill after three months.

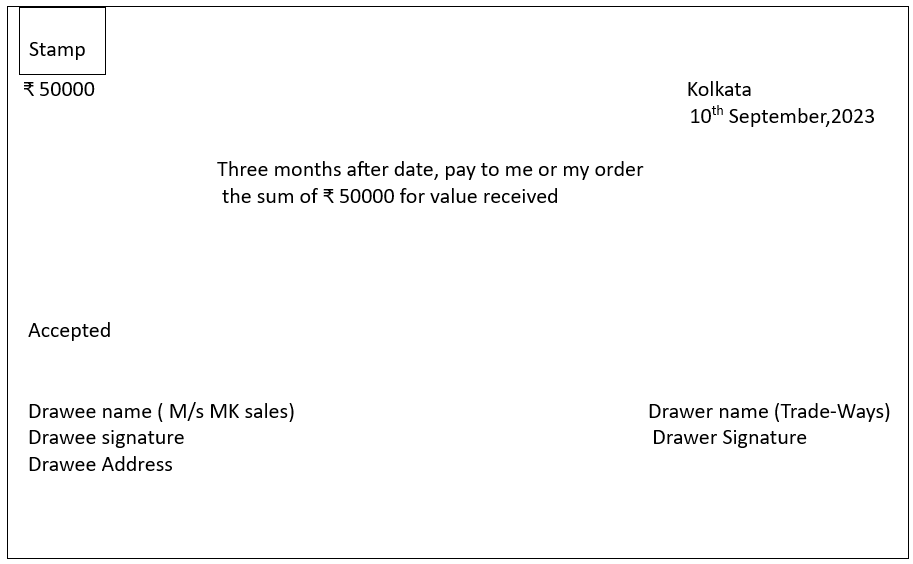

Bill of exchange: An Illustration

M/s Trade-ways has sold goods worth ₹50000 to M/s Mk sales on 10.9.23 and has drawn a bill of exchange on them for 3 months.

Relevant terms:

Maturity of Bill:

The term maturity refers to the date on which a bill of exchange becomes due for payment. Three days, known as the days of grace must be added to the date on which the amount of the bill falls due. This is a convention.

Thus, a bill dated 10th April and payable after 30 days will fall due 33 days counted after April 10 i.e. the due date would be May 13.

However, if the due date falls on a holiday under the Negotiable instrument Act, the instrument will fall due on the preceding business day. If 13th May is declared a holiday under NI Act, the due date would be 12th May.

Calculating the due date:

Due date of a bill = Date of the bill + Credit period + 3 days of days of grace

Examples:

| Date of Bill | Tenure (credit period) | Calculation | Due Date |

| 30th April, 2024 | 1 month | 1 month from 30th April, 2024 would be 31st May, 2024 + 3 days grace | 3rd June, 2024 |

| 1st June, 2024 | 30 days | 29 days (June) + 1 day (July) + 3 days grace | 4th July, 2024 |

| 1st January, 2024 | 60 days | 30 days (Jan) + 29 days (Feb) + 1 day (March) + 3 days grace | 4th March, 2024 |

| 28th January, 2024 | 1 month | 28th Feb is one month from 28thJan + 3 days grace (29th Feb + 2 days March) | 2nd March, 2024 |

| 23rd November, 2023 | 2 months | 2 months from 23rd November, 2023 will be 23rd January, 2024 + 3 days grace | 26th January, 2024 is a holiday, so it will be due on the preceding working day, i.e. 25th January, 2024 |

Discounting of Bill:

If the holder of the bill is in urgent need of fund, he can approach his banker for encashment of the bill before the due date. Subject to its discretion, the bank will make the payment of the bill amount after deducting charges called discounting charges. This process of premature encashment of a bill is called Bill discounting. After discounting, the Bank becomes the payee of the bill and will recover the money from the drawee on due date. Discounting of bills is a convenient way to access funds without waiting for the credit period and boost up working capital.

Endorsement of Bill:

Any holder of a bill can transfer a bill in favour of a third party unless the transfer is restricted. The bill can be endorsed by the drawer by putting his signature on the back of the instrument with the name of the party to whom it is being transferred. This signing and transferring is called endorsement. This way the holder of a bill can meet his obligations to creditors.

Accounting Treatment:

For the drawer of a bill of exchange who gets it back after its due acceptance by the drawee, the instrument is termed Bills Receivable. For the person who accepts the bill, it is Bill Payable. Bills receivable is an asset while bill payable is a liability. There are four ways to treat a bills transaction depending upon four conditions:

1. When the bill of exchange is retained by the drawer till the date of maturity

| Transaction | Books of Drawer/Creditor | Books of Acceptor/Debtor |

| Sale/Purchase of goods | Debtor’s A/c…………… Dr. To Sales A/c | Purchase A/c………………Dr To Creditor’s A/C |

| Receiving/Accepting the bill | Bills Receivable A/c… Dr. To Debtor’s A/c | Creditor’s A/c…………… Dr. To Bills Payable A/c |

| Collection of the Bill | Cash/Bank A/c……… Dr. To Bills Receivable A/c | Bills Payable A/c…………Dr. To Cash/Bank A/c |

2. When the bill is retained by the drawer and sent to bank for collection a few days before maturity

| Transaction | Books of Drawer/Creditor | Books of Acceptor/Debtor |

| Sale/Purchase of goods | Debtor’s A/c………….Dr. To Sales A/c | Purchase A/c……………..Dr. To Creditor’s A/c |

| Receiving/Accepting the Bill | Bills Receivable A/c…..Dr. To Debtor’s A/c | Creditor’s A/c…………..Dr. To Bills Payable A/c |

| Sending the Bill for collection | Bills sent for collection A/c…Dr. To Bills Receivable A/c | No Entry required |

| On receiving advice from bank that the bill has been collected | Bank A/c …………………… Dr. To Bills sent for collection A/c | Bills Payable A/c…………..Dr. To Bank A/c |

3. When the Drawer gets the bill discounted from the Bank

| Transaction | Books of Drawer/Creditor | Books of Acceptor/Debtor |

| Sale/Purchase of goods | Debtor’s A/c…………………Dr. To sales A/c | Purchase A/c……………….Dr. To creditor’s A/c |

| Receiving/Accepting the bill | Bills Receivable A/c………..Dr. To Debtor’s A/c | Creditor’s A/c……………Dr. To Bills Payable A/c |

| Discounting the Bill | Bank A/c………………Dr. Discount A/c……… .Dr. To Bills Receivable A/c | No entry required |

| On maturity of the Bill | No entry required | Bills Payable A/c …….. Dr. To Bank A/c |

4. When the Bill is endorsed by the Drawer in favour of his Creditor

| Transaction | Books of the Drawer/Creditor | Books of the Acceptor/debtor |

| Sale/purchase of goods | Debtor’s A/c…………….. Dr. To Sales A/c | Purchase A/c……………Dr. To Creditor’s A/c |

| Receiving/Accepting the Bill | Bills Receivable A/c ……Dr. To Debtor’s A/c | Creditor’s A/c……….. Dr. To Bills Payable A/c |

| Endorsing the Bill | Creditor’s A/c…………..Dr To Bills Receivable A/c | No entry required |

| On maturity of the Bill | No entry required | Bills Payable A/c……..Dr To Bank A/c |

Example 1

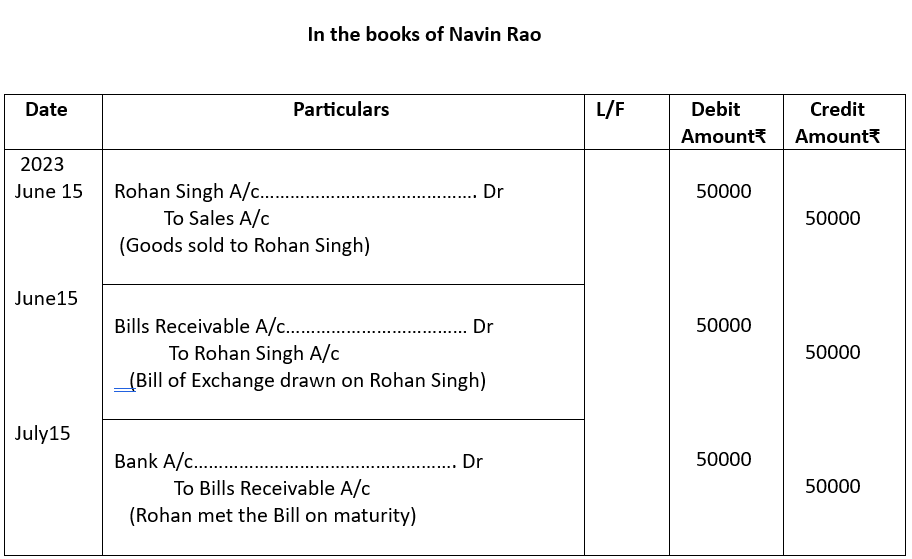

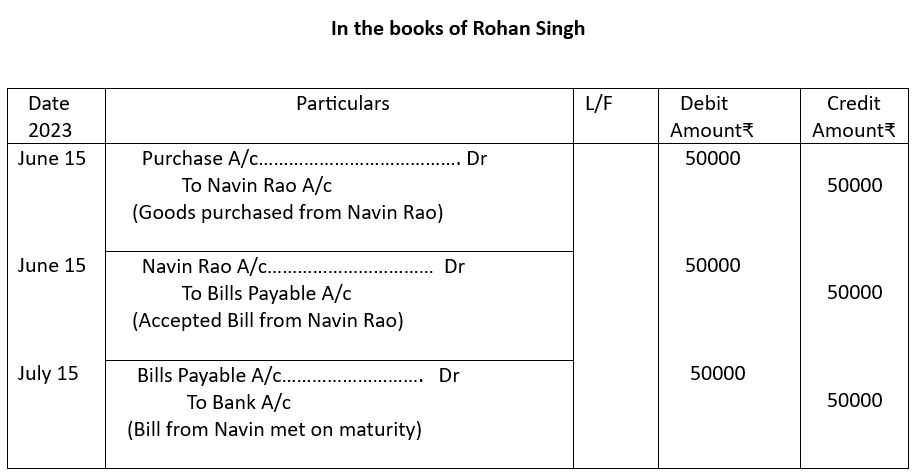

On 15th June, 2023 Navin Rao sold goods worth ₹50000 to Rohan Singh on credit. Navin drew a bill of exchange on Rohan payable after 30 days. Rohan accepted the bill and returned it to Navin. On the due date Navin presented the bill for payment and it was duly met by Rohan. Journalise the above transactions in the books of Navin and prepare accounts in the books of Rohan.

Solution:

Example 2

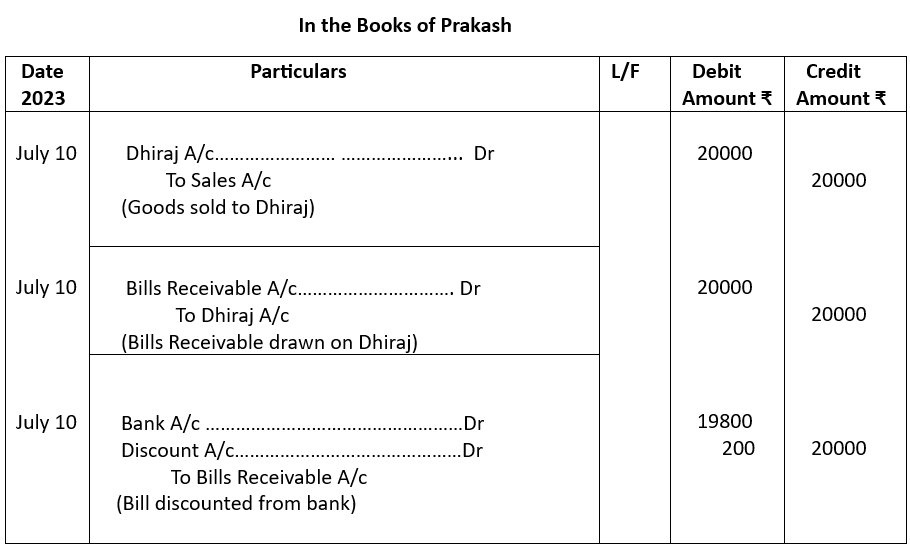

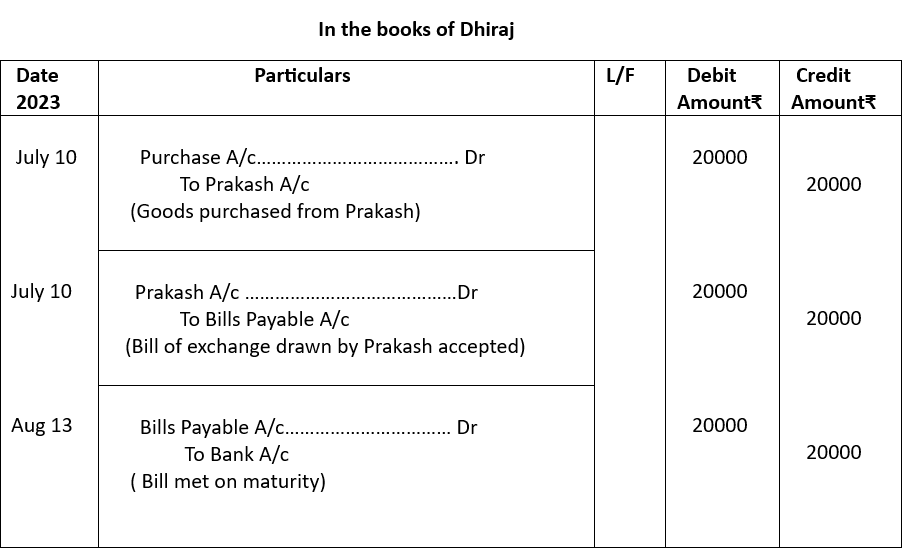

Prakash sold goods amounting ₹20000 to Dhiraj on 10th July 2023 and drew a bill of exchange on him payable after one month which was duly accepted by Dhiraj. Prakash immediately got the bill discounted from bank @ 12% p.a. Record the necessary entries in the books of Prakash and Dhiraj.

Solution:

Note: No entry required for payment on maturity as the bank will collect payment

CBSE Class 10 Elements of Book-Keeping and Accountancy Unit 4: Bills of Exchange – Completed

The following topics were covered in this unit:

Content:

Nature and use of Bill of Exchange

Terms used in Bills of Exchange

Simple transactions related to bills of exchange

Learning Outcomes:

Acquiring knowledge of using bills of exchange for financing business transactions

Understanding the need for bills of exchange in business

State the meaning of different terms used in bills of exchange and their implication in accounting

Develop the skill of journalising simple bill transactions in the books of debtor and creditor

Related Links:

Unit 1: Capital and Revenue

Unit 2: Depreciation

Unit 3: Bank Reconciliation Statement

Unit 4: Bills of Exchange

Unit 5: Final Accounts

Unit 6: Accounting from Incomplete records

Test Paper 1

Test Paper 2