Test Paper 2

Multiple Choice Type Questions

Select the correct answer:

1. Which of the following is true

a) Capital introduced is an income of the business

b) Bad debts is a loss to the business

c) Book keeping includes calculation of profit

d) None of the above

2. Revenue can be described

a) Increase in liabilities

b) Increase in assets

c) Decrease in liabilities

d) Inflow of cash from sale of goods

3. The purpose of Sales Books is

a) to record sales made by the firm

b) to record payment due to the creditor

c) to record all credit sales made by the firm

d) to record credit sales of goods made by the firm

4. Journal is called a book of _______.

a) Original entry

b) Secondary entry

c) Final entry

d) None of the above

5. Goods are sold for cash to ________.

a) Debtor

b) creditor

c) one who gives benefit to the business

d) buyer

6. Trial Balance is prepared for a particular period which is __________.

a) Week

b) Month

c) Quarter

d) Year

7. Transactions entered on the debit side of cash book are posted to_______.

a) Debit side of cash account

b) Debit side of respective ledger accounts

c) Credit side of respective ledger account

d) Credit side of the cash account

8. Cash withdrawn by the proprietor should be debited to_____________.

a) Drawings account

b) Capital account

c) Profit and loss account

d) Cash account

9. The book in which all accounts are maintained is known as ___________.

a) Cash Book

b) Journal

c) Purchase book

d) Ledger

10. Voucher is prepared from ________.

a) Documentary evidence

b) Journal entry

c) Ledger account

d) All of the above

11. Recording transactions in journal is called ________.

a) Casting

b) Posting

c) Journalising

d) Recording

12. Which one of the following is correct

a) Liabilities = Assets + Capital

b) Assets = Liabilities – Capital

c) Capital = Assets – Liabilities

d) Capital = Assets + Liabilities

13. The periodic total of sales return journal is posted to ____________

a) Sales account

b) Goods account

c) Purchase return account

d) Sales return account

14. Credit balance in bank account in cash book shows __________.

a) Overdraft

b) Cash deposited in bank

c) Cash withdrawn from bank

d) None of these

15. Total of these transactions is posted in purchase account ____________.

a) Purchase of furniture

b) Cash and credit purchase

c) Purchase return

d) Purchase of stationery

16. Balancing of account means___________.

a) Total of debit side

b) Total of credit side

c) Difference in total of debit and credit side

d) None of these

17. Which document is mentioned in the Purchase Return book __________.

a) Invoice

b) Cash memo

c) Debit note

d) Credit note

18. Prepaid Insurance is ___________.

a) an expense

b) an asset

c) a liability

d) none of the above

19. Cash discount received on payment to creditor is recorded on the

a) Credit side of cash column of cash book

b) On the debit side of the cash column of the cash book

c) On the credit side of the discount column of the cash book

d) On the debit side of the discount column of the cash book

20. Which of the following classifications is impossible?

a) Increase in an asset and decrease in another asset

b) Increase in an asset and increase in a liability

c) Decrease in a liability and increase in an asset

d) Decrease in an asset and decrease in a liability

21. The periodic total of sales return journal is posted to _________.

a) Sales account

b) Goods account

c) Purchase return account

d) Sales return account

22.When a firm maintains cash book, it need not maintain___________.

a) Journal proper

b) Purchase (journal) book

c) Sales journal boo

d) Bank and cash account in the ledger

23. How many sides does an account have?

a) Four

b) Two

c) One

d) Three

24) The primary condition that make accounting information useful is ___________.

a) Relevance

b) Reliability

c) Compatibility

d) None of the above

25. Trial Balance is ____________.

a) An account

b) A statement

c) A subsidiary book

d) A principal book

Short Answer Type Question (3 mark each)

1. Name three items which will come on the credit side of Debtor’s account.

2. What is the meaning of accounting equation?

3. Write any three limitations of writing a trial balance.

4. What is the difference between cash memo and invoice?

5. Mention three shortcomings of accounting information.

6. Why are source documents important in accounting?

7. Why profit is a liability for a business?

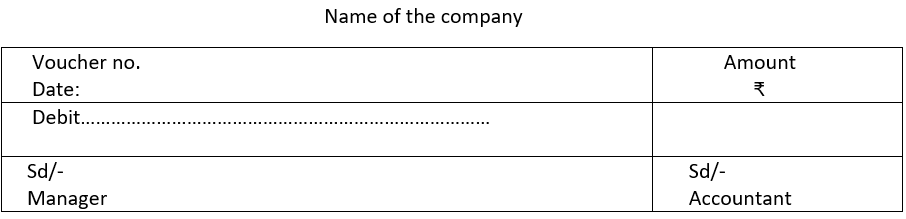

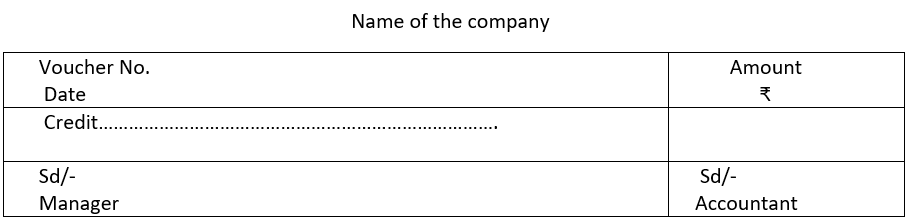

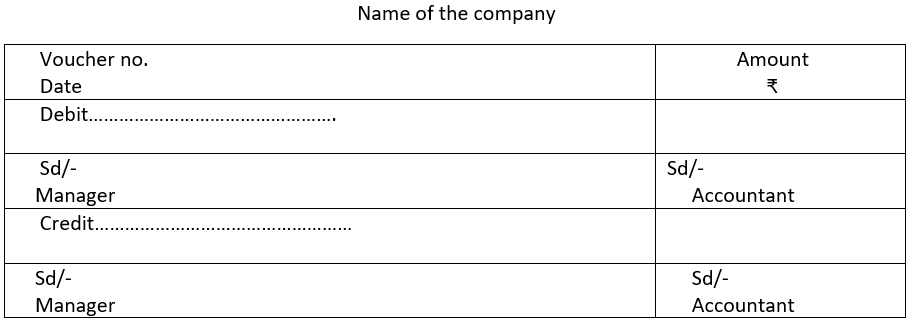

8. Give format of:

a) debit voucher

b) Credit voucher

c) Transfer voucher

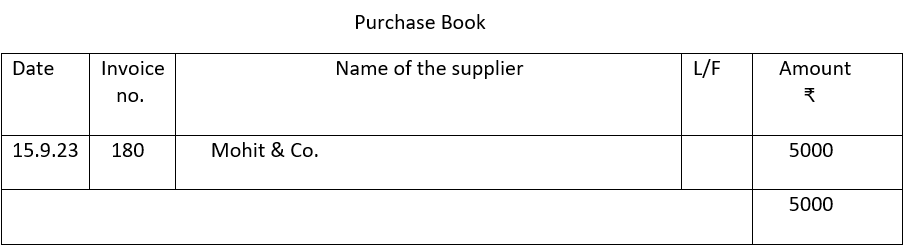

9. Prepare the Purchase book from the following:

a) Purchase of goods costing ₹5000 from M/s. Mohit & Co. vide invoice no.180 dt.15.9.23

b) Purchase of furniture costing ₹9000 from M/s. Rajan & Sons. Vide invoice no.20 dt 19.9.23

c) Returned goods costing ₹500 to M/s. Mohit & Co. vide debit note no.47 dt.17.9.23

10. Mention three entries which appear in journal proper?

11. Why are the rules of debit and credit same for both liability and capital?

12. i) If a transaction has the effect of decreasing an asset, is the decrease recorded in debit or credit?

ii) If a transaction has the effect of decreasing liability, is the decrease recorded in debit or credit?

Short question (4 mark each)

1. What effect will the following transactions have on the various elements of accounting equation?

a) Drawings by cheque

b) Paid cash to creditor

c) Cash purchases

d) Salaries payable.

2. State three fundamental steps in accounting process.

3. What are the four steps to record Credit Sales?

4. What are the qualitative characteristics of accounting?

5. Name the subsidiary books in which the following transactions will be recorded.

i) Cash purchase of goods

ii) Cash purchase of office furniture

iii) Credit purchase of goods

iv) Credit purchase of office furniture

6. Match the following:

| (a) The amount with which the business is started | i) debt |

| (b) A person who owes money to the business | ii) debtor |

| (c) A person to whom the business owes money | iii) Creditor |

| (d) Amount borrowed by a business | iv) Capital_ |

Application Based (6 mark each)

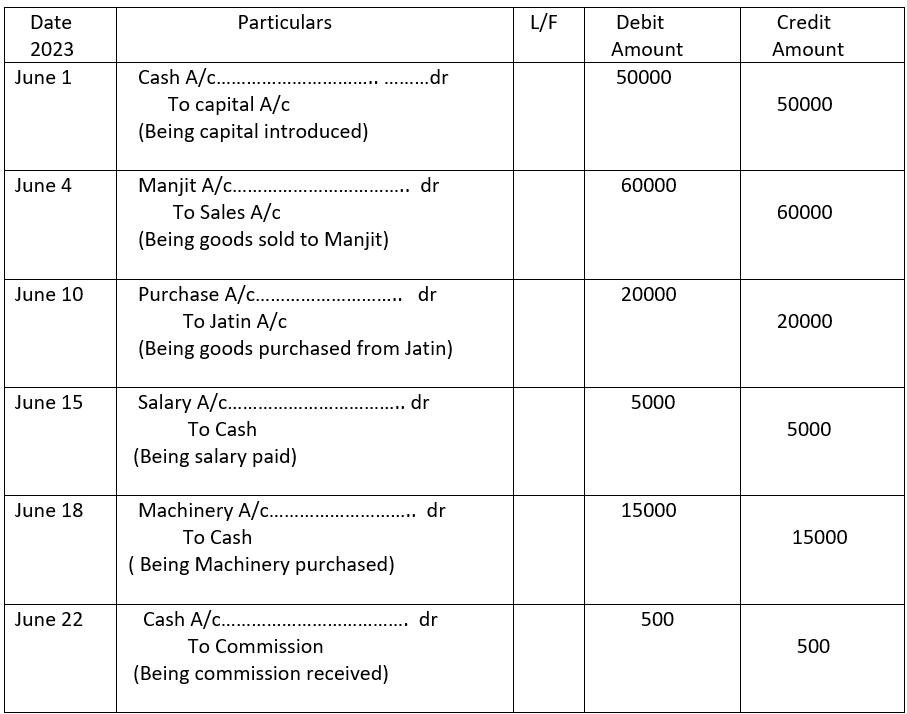

1. Journalise the following transactions

| Date 2023 | Transactions | Amount ₹ |

| June 1 | Started business with cash | 50000 |

| June 4 | Sold goods to Manjit | 60000 |

| June 10 | Goods purchased from Jatin | 20000 |

| June 15 | Paid salary | 5000 |

| June 18 | Machinery Purchased | 15000 |

| June 22 | Commission received | 500 |

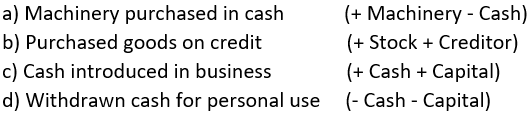

2. Give business transactions for each of the following records

a) Increase in one asset and decrease in another asset

b) Increase in one asset and increase in liabilities

c) Increase the assets and increase the capital

d) Decrease the asset and decrease the capital

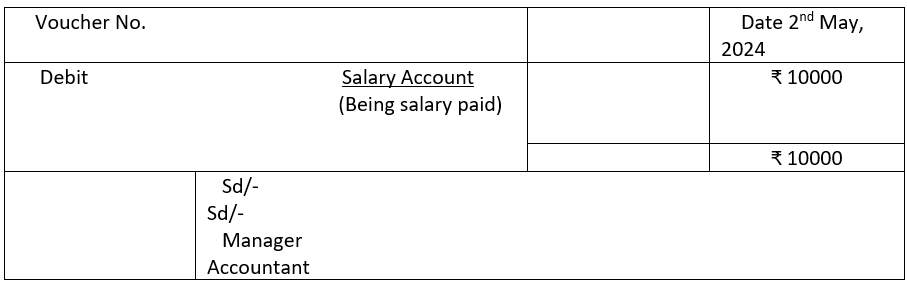

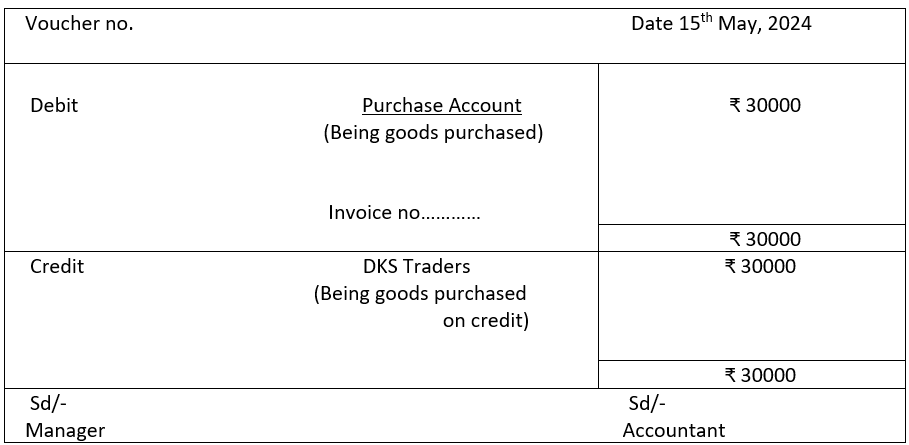

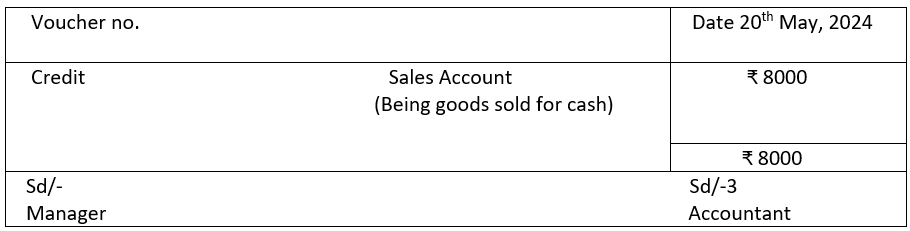

3. Prepare Accounting Vouchers for the following transactions in the books of Rajan & Co.

a) Salary paid ₹ 10000 on 2nd May 2024

b) Goods purchased on 15th May from DKS traders ₹30000

c) Sold goods for cash for ₹8000 on 20th May 2024

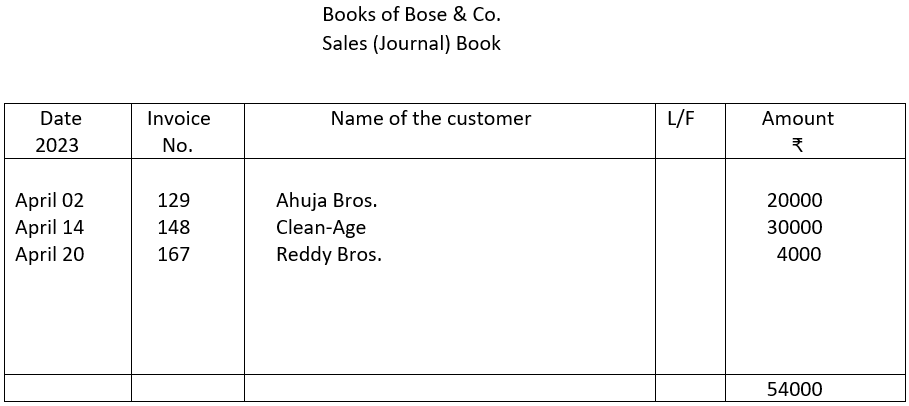

4. Enter the following transactions in Sales (journal) Book

i) Two water purifiers were sold on credit to Ahuja Bros for ₹ 20000 as per invoice no 129 dt. 2.4.23

ii) Two air purifier were sold on credit to M/s Clean-age for ₹ 30000 as per invoice no. 148 dt. 14.4.23

iii) Four filters were sold on credit to Reddy Bros. for ₹ 4000 as per invoice no 167 dt 20.4.23

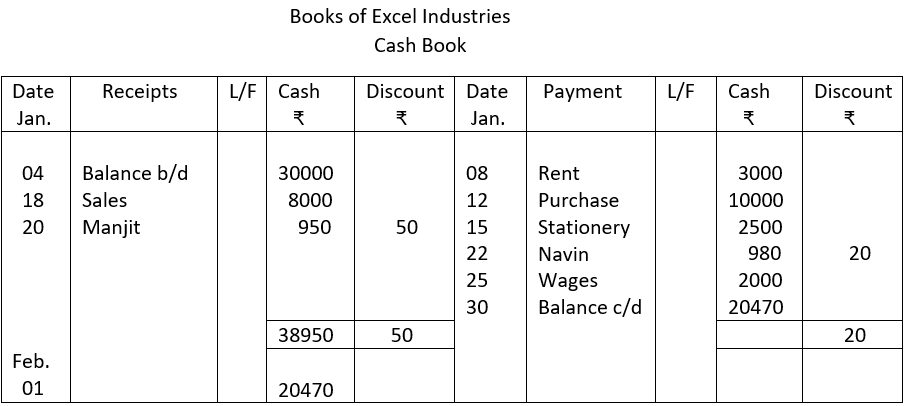

5. Prepare a Cash Book with discount column in the books of Excel Industries from the following transactions and balance it:

| Date 2024 | Particulars |

| Jan 04 | Balance of cash in hand ₹30000 |

| Jan 08 | Rent paid ₹ 3000 |

| Jan 12 | Purchased Goods for cash ₹10000 |

| Jan 15 | Stationery purchased ₹2500 |

| Jan 18 | Sold goods for cash ₹8000 |

| Jan 20 | Cash received from Manjit ₹950 allowed discount ₹50 |

| Jan 22 | Cash paid to Navin ₹ 980 received discount ₹20 |

| Jan 25 | Wages paid ₹2000 |

6. Give four examples of entries recorded in Journal Proper

Solution: Test Paper 2

Answers to Multiple Choice Type Questions (1 mark)

1. (b) is correct

2. (d) is correct

3. (d) is correct

4. (a) is correct

5. (d) is correct

6. (d) is correct

7. (c) is correct

8. (a) is correct

9. (d) is correct

10. (a) is correct

11. (c) is correct

12. (c) is correct

13. (a) is correct

14. (a) is correct

15. (b) is correct

16. (c) is correct

17. (c) is correct

18. (b) is correct

19. (c) is correct

20. (c) is correct

21. (d) is correct

22. (d) is correct

23. (b) is correct

24. (b) is correct

25. (b) is correct

Answers to Short Answer Type Questions (3 mark each)

1. i) Cash payment

ii) Cheque payment

iii) Discount allowed

2. Accounting equation refers to a statement of equality between debits and credits signifying that assets of a business are always equal to the total liability and capital. It is expressed as:

Assets = Liabilities + Capital.

3. The limitations of trial balance are:

i) Errors of Commission which are due to wrong posting, casting or balancing of accounts

ii) Errors of Omission that happen when a transaction is completely/partially omitted from

accounting records

iii) Errors of Principles like debiting purchase when machinery is purchased flouting rules

4.

| Cash Memo | Invoice |

| 1. It is issued for cash sales | 1. Invoice is for credit sales |

| 2. Cash memo may not contain detail of the buyer | 2. Invoice must contain name and other detail of the buyer. |

| 3. Cash memo not be issued for small transactions | 3. Invoice must be issued for all credit sales |

5. i) Accounting information is only quantitative. It does not give any qualitative idea of transactions.

ii) Accounting information can be biased or subjective.

iii) Sometimes, accounting information is based on estimates which are not correct.

6. i) Source documents are proof of business transactions that have taken place.

ii) Source documents are important reference points in auditing work.

iii) The documents can be presented as evidence in court cases.

7. Capital is the investment of the owners and it represents claims on assets of the business and the profits earned by it. For the business entity profit is a liability to be added to capital.

8. (a) Debit Voucher:

(b) Credit Voucher

(c) Transfer Voucher

9.

Note 1. Furniture purchased on credit is not entered in Purchase Book

Note 2. Return of purchased goods is not entered in Purchase book

10. Examples of entries that appear in journal proper:

(a) Outstanding Expenses

(b) Prepaid Expenses

(c) Entries for dishonour of bills

11. Capital is an investment by the owners having claims on assets of the business. So, is treated as liability by the business entity. Likewise, other liabilities for example creditors also have a claim on the assets of the business. This is why Capital and other liabilities are treated similarly as per

accounting rules which are:

a) Increase is credited

b) decrease is debited

12. i) Decreasing an asset is recorded as credit

ii) Decrease a liability is recorded as debit

Answers to Short Answer Type Question– 4 mark each:

1.

a) Drawings by cheque will reduce capital and reduce Bank (Assets)

b) Cash ( Assets) will be reduced and Creditor (liability) will be reduced

c) Stock Asset will be increased and Cash (Asset) will be reduced

d) Salary payable will increase liability and salary will reduce profit and thus capital

(hint: Salary account debit to Outstanding salary account)

2.

a) Identification of economic transaction

b) Recording of transaction

c) Communication

3.

a) dispatched

b) invoiced

c) delivered

d) paid for

4.

a) Reliability

b) Understandability

c) Relevance

d) Comparability

5.

a) Cash Book

b) Cash Book

c) Purchase Day Book

d) Journal Proper

6.

| a) The amount with which the business is started | iv) Capital |

| (b) A person who owes money to the business | ii) debtor |

| (c) A person to whom the business owes money | iii) Creditor |

| (d) Amount borrowed by a business | i) debt |

Answers to Application Based Questions (6 mark each)

1.

2.

3.

In the books of Rajan & Co.

a) Debit Voucher

b) Transfer Voucher

c) Credit Voucher

4.

5.

6. Examples of entries recorded in Journal Proper:

a) Furniture A/c………………………………..Dr.

To Modern Furniture A/c

( Being furniture purchased on credit)

b)

Hari & Sons A/c……………………………Dr.

To Discount A/c.

(Being discount received from Hari & Sons.)

c)

Machinery A/c…………………………. Dr

To Raj & Co. A/c

(Being Machinery purchased on credit)

d)

Salary A/c ………………………………… Dr

To Outstanding Salary A/c

(Being salary outstanding)

CBSE Class 9 Elements of Book-Keeping and Accountancy – Test Paper 2 – Completed