Content:

Introduction to Book keeping and Accounting

Need, objectives, advantages

Learning Outcomes:

Identifying the need for Book Keeping

Understanding the objectives of Book Keeping

Understanding the advantages of Book Keeping

Meaning, objectives and advantages of Book Keeping

Book keeping defined:

Book-keeping is the “art and science of recording business transactions in a systematic and chronological order”. It is an art because it paints the financial picture of a business and a science as it is based on principles and techniques which have stood the test of time.

Book-keeping is thus a narrative of the financial transactions that take place in any business organisation each of which is split into two equal parts – debit and credit.

Book keeping records, classifies and summarises every transaction like cash, purchase, sales, debtor, creditor etc., in chronological order The function of book-keeping is elementary in nature and repetitive as well but lays the foundation of more advanced accounting techniques.

Need for Book-Keeping:

1. The primary need of book-keeping arises from keeping elementary records of financial transactions of a business as it is not possible to memorise and recall innumerable transactions that take place in a business. It acts as the hard copy of the transactions upon which the accounting framework rests.

2. Through book-keeping basic control over critical transactions like Sale, Purchase, Debtor, Creditor and cash can be exercised.

3. Book-keeping is the primary data to work out final accounts that give an idea of profit/loss which a business is making.

4. Another important role of book-keeping is classification of transactions under different account heads and linking them with source documents of transactions without which there would be no record.

Book-keeping – Objectives

1. Identification of transactions: One of the most important objectives of Book-keeping is to identify transactions on the basis vouchers and memos and classify them into different account heads like sale, purchase, debtor, creditor, cash, wages, interest etc.

2. Measurement of transactions: Another objective of book-keeping is to express every transaction in money terms to act as future reference points.

3. Systematic recording of transactions: Transactions are recorded systematically in Book-keeping so that they can be accessed whenever necessary. This is done through different books of entry depending on the nature of the transactions.

Advantages of Book-keeping:

1. Composite Records: Complete record of business transactions are kept under book keeping procedure. This can be recalled any time in future eliminating the near impossible task of memorising them.

2. Prevention of fraud: The detail recording of financial transactions eliminates irregularities and frauds to a large extent. Irregularities if any can be detected under vigilance.

3. Legal evidence: Legal disputes often arise in business transactions, so the relevant papers like bills, vouchers can be produced as evidence.

Accounting – an introduction:

We have seen that Book-keeping is a repetitive process of recording transactions on a day-to-day basis. Accounting is a dynamic subject. Its role is not restricted to basic economic transactions, It goes much beyond that such as calculating the profitability of a business, ascertaining its financial stability and providing vital accounting information to users, both internal and external. According to American Accounting Association the function of accounting is to provide quantitative information of financial nature about economic entities that is intended to be useful for making economic decisions.

Origin of Accounting and Luca Pacioli

Accounting has a remarkable heritage. It was existent in Egypt and Babylonia some 4000 years back. Twenty-three centuries ago, Kautilya wrote “Arthasashtra” where he had mentioned about accounting records. But, modern Accounting with double entry system as its backbone was invented by Italian mathematician Luca Pacioli in 1494. In his book “Arithmetica, Geometrica, Proportion at Proportionality” he used the present-day concept of debit and credit. He discussed details of memorandum, journal and ledger and specialised accounting procedures.

Meaning of Accounting:

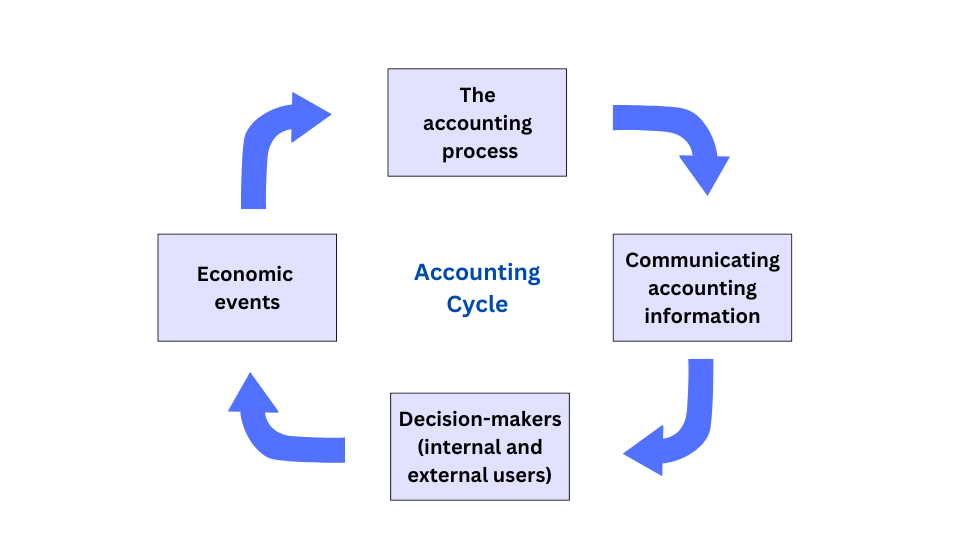

Accounting can be defined as the process of identifying, processing, recording and communicating the required information relating to the economic events of an organisation like sale, purchase, payments and receivables etc. to the interested users of such information. So, the accounting system has four relevant aspects:

1. Economic events: Tracking economic events of a business organisation. Economic events mean transactions taking place in course of business process which are measurable in monetary values.

2. Identification, Measurement, Recording and Communication: This is essential to find out profit/loss of a business and a vital tool for management control.

3. Organisation: Dealing with transactions of different economic entities like proprietorship, partnership, private and public enterprises, even those of non-profit organisations.

4. Information: Accounting is the process through which necessary financial information about the business enterprise is communicated to internal and external users. Internal users are business managers, plant managers etc. and external users are investors, tax authorities, banks etc. It is also called the language of the business. These aspects of the accounting process are linked together as shown below:

Objectives of Accounting:

Accounting in modern times is an information system the purpose of which is to provide useful data to the interested group of users, both internal and external. The primary objectives of accounting include the following:

1. Maintenance of records of business transactions:

Accounting keeps a systematic record of all business transactions ensuring easy reference and verifiability. This is necessary to prevent fraud and fund defalcation. It acts as the protection shield of a business.

2. Calculation of Profit and Loss:

Ascertaining the profit or loss during a particular year is an extremely important objective of accounting as a whole because the owners of the businesses eagerly await such results. Preparation of financial statements like Balance Sheet and Profit & Loss account is thus an important contribution of accounting procedure.

3. Analysis and communication of accounting results

Analysis of financial position, specifically the Balance sheet, preparation of reports, statements and graphs are key materials for both internal and external users. To generate such statements communicating them to users like potential investors, lenders, suppliers, creditors, regulatory bodies etc. are vital contributions of accounting. This accounting information system generated through modern analytical applications is of strategic importance to a business enterprise.

4. Decision making tool:

The analytical reports, charts and graphs generated through the accounting system help the management team to adopt correct strategies in a competitive business environment. Fund raising also becomes easy.

Advantages of Accounting:

The advantages of accounting are many:

1. Comprehensive record: Details of all the transactions are available in the Books of accounts maintained by a business enterprise. As data kept are in chronological order, they can be easily traced for future reference. Thus, constant monitoring of important accounts like sale, purchase, cash etc., becomes possible.

2. Projection of financial position: The profit/loss as shown in the accounts helps management to evaluate the business correctly and take appropriate steps.

3. Comparative study: Accounting techniques facilitate comparative assessment of present year’s performance against past years so that the business runs at a steady pace.

4. Evidence in court: As detailed accounting records are kept with supporting vouchers; they can be produced in court as evidence in case of any legal /taxation matters.

5. Business valuation: Proper accounting helps figure out proper valuation of a business which becomes handy when a business is put on sale or declares insolvency.

6. Fund raising utility: Business establishments constantly need additional funds to expand. Banks and other lenders need proof of economic viability of the proposals in the form of Balance sheet and other financial statements. These documents are generated through the accounting system and play a crucial role in obtaining sanction.

Book-keeping and Accounting – Comparison

| Book-keeping | Accounting |

| 1. Book-keeping is about recording business transactions in the primary books of entry i.e., journal and ledger on day-to-day basis. | 1. Accounting starts with checking arithmetical accuracy of recorded entries and goes on to prepare profit & Loss account and Balance Sheet. Accounting starts where Book-keeping ends. |

| 2. Classification of Accounts is the important of function of Book-keeping. | 2. Accounting is concerned with overall results and transactions. |

| 3. Book-keeping breaks up transactions into debit and credit. | 3. Accounting calculates profit/loss of a business. |

| 4. The function of book-keeping is repetitive in nature. | 4. Accounting is a dynamic concept. It finds out profitability, analyses the results and acts as management information system. |

Generally Accepted Accounting Principles (GAPP):

Certain generally accepted rules and principles have been developed which are generally accepted by the accounting profession as standard practice. It refers to the rules or guidelines adopted for recording and reporting of business transactions for uniform preparation and presentation of financial statements. For example, one of the important rules is to record all transactions on the basis of historical cost which is verifiable from the documents such as cash receipt for money paid. These principles have evolved over a long period of time and are still getting modified through changes in legal, social and economic environment and needs of present-day users. These principles, conventions, assumptions etc. are referred to as the Basic Accounting Concepts described below:

Some Accounting Terms

1. Transaction: Transaction is an event involving some value between two or more entities. It can be purchase of goods, receipt of money, payment to a creditor, incurring expenses etc. A transaction can be a cash transaction or a credit transaction. Value or monetary consideration is the essential element of a transaction and a claim on the assets of the company.

2. Capital: Capital is the amount invested by the owner in a firm. It may be brought in the form of cash or other assets. For the business entity capital is an obligation and a claim on the assets of the company, or in other words, capital is liability for the business entity.

3.Assets: Assets are economic resources that can be utilised by an enterprise. Thus, assets are items of value expressed in monetary terms. Plant and Machinery, Furniture, Stock of goods, cash etc. are some of the examples of Assets

4. Liabilities: Liabilities are obligations of an enterprise which it has to meet in future. Liabilities are also expressed in terms of money that indicate the debt burden of the concern. Short term liabilities include Bills payable, Creditors, Short term loans etc, and long-term liabilities are long term, borrowings, deferred tax liabilities etc,

5. Revenues: Revenue is the amount earned by a company by selling its products and services to customers. Other sources of revenue include interest, commission, dividends royalties etc.

6. Expenses: Costs incurred by a business in the process of earning revenue are known as expenses. Expenses are values of assets consumed like cost of asset such as depreciation or cost of services used like wages, salaries, electricity charges etc.

7. Expenditure: Expenditures are incurred for long term benefits of a business enterprise. Purchasing Land and Buildings, Plant & Machinery, Furniture, Stock of goods are examples of Expenditure. If the benefit of the expenditure is exhausted in a year it is treated as expense or revenue expenditure. Long term expenditure is treated as capital expenditure.

8. Goods: Goods are products with which a business unit is dealing. Goods may be purchased to resell them or goods may be manufactured to sell them. But items purchased for the company’s own use are not goods, they are treated as assets.

9. Stock: Stock or inventory are items like raw-materials, work-in-process, finished items, spares etc. which remain in hand at any point of time in an accounting period. Opening stock is the opening amount of stock in hand while closing stock is calculated at the end of the accounting period .

10. Purchase: Purchases are total amount of goods procured by a business both in cash and credit basis. In a trading concern purchases are made for resell purpose. In a manufacturing unit, raw materials are purchased and then processed further to produce finished goods. Purchase may be cash or credit purchase.

11. Sales: Sales are total revenues generated by goods and/or services provided to customers. Sales may also be on cash or credit basis.

12. Profit: Profit is the excess of revenue over related expenses. Profit is added to investment or capital employed by the owner/s.

13. Gain: While profit is earned in regular course of a business, gain arises from transactions which are incidental to the business such as sale of a fixed asset, awards from court case, upward valuation of asset etc. Gain is windfall income.

14. Loss: When expenses of a business are more than the revenue generation, a business enterprise is said to be suffering loss. Loss also refers to money or money’s worth lost in accident, fire or theft. Loss decreases owner’s investment/capital.

15. Drawings: Withdrawal of cash or goods by the owner/owners for personal use is known as drawings. Drawings reduces the capital invested by the owner.

16. Discount: Discount is the deduction in the price of goods sold. Discounts may be cash discount transactions given as an incentive for early payment. There may be trade discounts allowed to promote sales. Discounts are expenses. A company may also receive discounts from parties on similar grounds.

17. Debtors: Debtors are entities who owe an enterprise certain amount for buying goods and services on credit. The total of such outstanding amount standing at the end of an accounting period is shown in the asset side of the Balance Sheet as ‘Sundry Debtors’.

18. Creditors: Creditors are persons or other entities who have provided goods and services to an enterprise on credit. The total of such outstanding amount is treated as liability and shown as Sundry Creditors in the Balance Sheet.

19. Bad debt: Large amount of sales of a business enterprise is normally on credit terms. Often part of the sale proceeds remains unrecovered. This is called Bad Debt and treated as an expense. Sometimes reserves are made for anticipated bad debts and then the actual amount is adjusted against it.

20. Voucher: The documentary evidence in support of a transaction is called a voucher. For example, if we buy goods for cash we get a cash memo, if we buy on credit we get an invoice, when we make payments we get a receipt and so on. These documents are the basis of recording the transactions.

CBSE Class 9 Elements of Book-Keeping and Accountancy Unit 1: Introduction to Book keeping and Accounting – Completed

We have completed the following topics in this unit:

Content:

Introduction to Book keeping and Accounting

Need, objectives, advantages

Learning Outcomes:

Identifying the need for Book Keeping

Understanding the objectives of Book Keeping

Understanding the advantages of Book Keeping

Meaning, objectives and advantages of Book Keeping

Related Links:

Unit 1: Introduction to Book keeping and Accounting

Unit 2: Accounting Equation Effects

Unit 3: Nature of Accounts and Rules of Debit and Credit

Unit 4: Journal

Unit 5: Ledger

Unit 6: Recording and posting of cash transactions

Unit 7: Trial Balance

Test Paper 1

Test Paper 2