Content:

Business Entity Concept

Dual Aspect of the Transaction and the Accounting Equation

Effect of Transactions on Accounting Equation

Learning Outcomes:

Understand the importance of Business Entity concept

Explain the concept of accounting equation

Appreciate that every transaction affects the accounting equation

1. Business Entity Concept:

The concept of Business Entity assumes that a business unit has a distinct and separate entity other than that of its owner. It means, for the purpose of accounting, the business and its owner are to be treated as two separate units. Thus, when a person brings in money as capital into the business the money so introduced is treated as a liability in the books of the business as it is an investment on the part of the concerned person. The same person may invest in a number of businesses and they will all have separate identities distinct from the investor. The accounting records are made in the books of accounts from the point of view of the business and it is not a personal financial record of the owner. For example, the IOL limited is a business entity totally separate from its thousands of shareholders/investors.

2. Money Measurement Concept:

The concept of money measurement states that only those transactions which can be expressed in terms of money are recorded in the books of accounts such as amount of sale or purchase, payment of salaries or receipt of income etc. But appointment of a manager, for example, is a happening which is recorded elsewhere but not in the Books of Accounts.

3. Going Concern concept:

This concept assumes that a business enterprise will continue to carry on business indefinitely i.e. for a fairly long period of time. This is important from the point of Asset valuation. As every Asset has specific service life, the going concern assumption allows accountants to distribute the cost of the Asset over a length of time without recovering the cost in one/two years which would adversely affect profitability of that year.

4. Cost Concept:

The Cost concept requires that all assets are recorded in the book of accounts at their purchase price, which include cost of acquisition, transportation and installation. Adoption of cost concept brings in objectivity in the cost of acquisition which is easily verifiable from purchase documents.

5. Dual aspect Concept:

Dual aspect concept is the foundation of accountancy. It provides the very basis of recording transactions in book of accounts. It says that every transaction has a dual or two-fold effect and therefore must be recorded in two places or two accounts. The duality principle is expressed in terms of the fundamental Accounting Equation:

Assets = Liabilities + Capital

This means assets of a business are always equal to the claims of owners and outsiders.

6. Revenue Recognition (realisation) Concept:

The concept of revenue recognition requires that the revenue for a business transaction should be included in the accounting records only when it is realised. Revenue from sale of goods and services is assumed to be realised when a legal right to receive it arises i.e. the point of time goods have been sold or service has been rendered. Thus, credit sales are treated as revenue on the day sales are made and not on the day payment is received.

7. Matching Concept

Ascertaining the amount of profit earned or loss incurred during a particular accounting period involves deduction of related expenses from the revenue. The matching concept emphasises that revenues earned during a particular year must be matched against the expenses incurred during the same year to arrive at correct profit or loss figure. It states that all revenue, cash or otherwise, earned during a year has to be adjusted against all expenses paid or outstanding in the same year. Thus, revenue is recognised when a sale is complete rather than when payment is received. Similarly, expenses such as salaries, rent etc. are recognised for the period to which they relate to rather than when they are actually paid.

8. Cash and Accrual basis:

There are two broad approaches regarding timing of recognition of revenue and costs like

a) Cash basis

b) Accrual basis

Under cash basis entries in the books of accounts are made when cash is received or paid. But in accrual method however revenues and costs are recognised in the period they occur rather than when they are paid or received. For example, goods sold for credit will be accounted for when payment is actually received. This is incompatible with the idea of matching concept which states that expenses incurred during an accounting period should be corelated with revenues of the same year. Otherwise, the accounts will not reflect true profit and loss of the business.

Dual Aspect of Transaction and the Accounting Equation:

The dual aspect of a transaction is the conceptual foundation of accounting. It is the basic principle for recording business transactions in the books of accounts. The principle states that every business transaction has dual aspect and should be split into two separate accounts as debit and credit and the total amount debited must be equal to total amount credited.

Let us consider the following examples:

1. Mohan & co. sold goods for cash ₹ 50000

Here, we have two aspects of the transaction – cash and sales. One aspect is cash of ₹ 50000 which will be added to assets of Mohan & Co. and the other aspect is Sale of goods which decreases stock

of goods or assets by ₹50000.

2. Purchased goods on credit ₹ 25000

Here, one aspect of the transaction is Purchase increasing stock of goods or the Asset value by ₹25000. The second aspect will be the Creditor of ₹ 25000 which would be added to Liability so that assets and liabilities remain the same.

The duality principle is commonly expressed in terms of fundamental Accounting Equation which is

A = C + L where,

A = Assets

C = Capital

L = Liabilities

The equation states that the assets of a business are always equal to the claims of owners and outsiders. The claims of owners are the equity / investment brought in by them and claims of outsiders are those of creditors. The two-fold effect in respect of all transactions must be recorded in the books of accounts of the business and ultimately the Assets and Liabilities must agree. This duality concept forms the core of Double Entry System of Accounting.

The above equation can be written in the following forms to obtain the values of Capital and Liabilities. Thus,

(i) A – L = C

(ii) A – C = L

Effects of transactions on Accounting Equation:

Transaction 1:

Rohit started a business with ₹ 50000.

Analysis of the transaction:

Creation of Assets (cash) ₹ 50000

Creation of liability (Capital) ₹ 50000

In terms of accounting equation the transaction can be expressed as

Assets (50000) = Liabilities (50000)

Transaction 2.

Rohit purchases a printer for ₹ 10000 for office use.

Analysis of the transaction:

Cash (Asset) will be reduced by ₹ 10000

Office equipment (Asset) will be increased by ₹ 10000

So, total asset will be unchanged

Liabilities remain unaffected

Thus, the equation will be:

Assets ₹50000 – ₹ 10000 (cash) + ₹ 10000 (Printer) = Liabilities ₹ 50000 or

Assets ₹ 50000 = Liabilities ₹ 50000

Transaction 3.

Rohit opened a Bank account in company’s name for ₹10000.

Analysis of the transaction:

Cash will be reduced by ₹10000

Bank Balance (new) will be increased by ₹10000

Thus, Asset side total will remain unchanged

The equation will be:

Assets ₹50000 – ₹10000 (cash) +₹10000 (Bank) = ₹50000

Liabilities remain unchanged ₹50000

Transaction 4.

Rohit bought plant & machinery for his business for ₹200000 after paying an advance of ₹20000

Analysis of the transaction:

The transaction increases Asset side (plant & machinery) by ₹200000 decreases cash by ₹20000 (advance). The transaction creates Creditor by ₹180000 as liability

So, the equation will be:

Assets = ₹ 50000 – ₹ 20000 + ₹200000 = ₹ 230000

Liabilities = ₹50000 + ₹180000 = ₹230000

Transaction 5.

Goods worth ₹50000 purchased from John & Co. on credit.

Analysis of transaction:

The transaction increases stock on the asset side by ₹ 50000 and increases liability (creditor – John & co) by ₹50000. So, the equation will be:

Assets + Stock = Liabilities+ Creditors or ₹230000 + ₹ 50000 = ₹ 50000 + ₹230000

0r ₹280000 = ₹280000

Transaction 6.

Rohit sold goods worth ₹ 40000 to Ankit for ₹ 50000 on credit.

Analysis of transaction :

Sale of goods costing ₹ 40000 reduces stock, Sale price of ₹50000 increases debtor on the asset side, balance ₹10000 as profit is added to capital on the liability side.

So, the equation will be :

Assets : ₹280000 – ₹ 40000 ( stock) + ₹50000 Debtor (sale of goods) = Liabilities ₹50000 ( capital) +

₹10000 ( profit) + ₹230000 (creditor)

or ₹ 290000 = ₹ 290000

Examples :

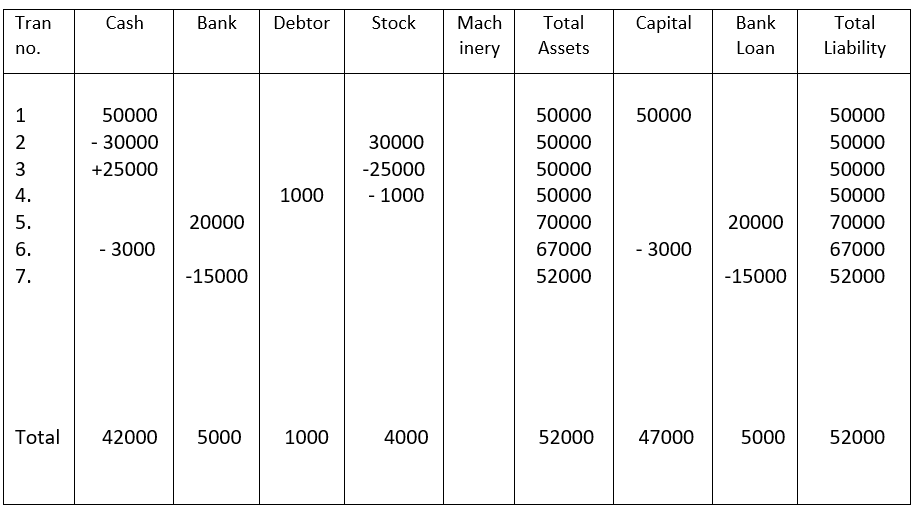

Example 1

| 1. Commenced business with | ₹ 50000 |

| 2. Purchased goods for processing | ₹ 30000 |

| 3. Sold goods for cash | ₹ 25000 |

| 4. Sold goods for credit | ₹ 1000 |

| 5. Borrowed from bank | ₹ 20000 |

| 6. Paid expenditure | ₹ 3000 |

| 7. Paid back bank loan | ₹ 15000 |

Analysis of the above transactions:

1. Creation of Asset (cash) and Liability (Capital)

2. Increase in stock and decrease in cash in Assets

3. Decrease in Stock Increase in Cash in Assets

4. Decrease in stock and Increase in Debtor

5. Increase in Bank balance in Assets Increase in Loan in Liabilities

6. Decrease in Cash in Assets. Decrease in Capital for expenses

7. Decrease in Bank balance in Assets. Decrease in Loan in Liabilities

The Equation table of the transactions:

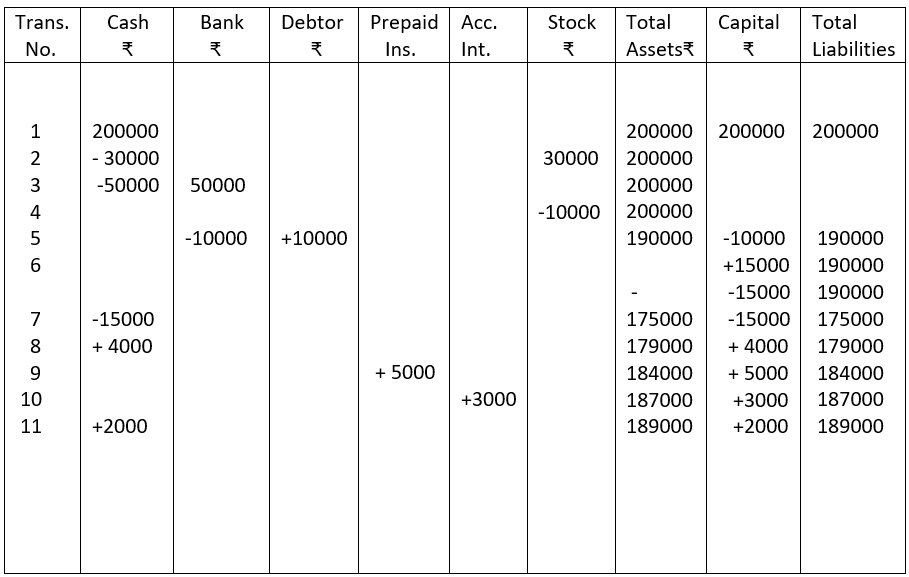

Example 2:

1. Bipin started business with cash ₹200000

2. Purchased goods ₹ 30000

3. Deposited into Bank ₹50000

4. Sold goods to Rajiv ₹ 10000

5. Paid rent by cheque ₹10000

6. Salary outstanding ₹15000

7. Paid salary ₹15000

8. Received commission 4000

9. Prepaid Insurance ₹5000

10. Interest due but not received ₹3000

11. Interest received in advance ₹2000

Analysis of Transactions:

1. Cash introduced as capital So, Asset (cash) and Capital will increase

2. Stock increases while cash is reduced, thus Assets remain unaffected

3. Cash is reduced while Bank is increased, Assets remain unaffected

4. Stock is getting reduced by sales, as it is a credit sale, debtor is increased, so Assets are unaffected.

5. Bank is reduced as rent is paid by cheque while Capital is decreased as rent is an expense

6. Outstanding salary increases liability and decreases capital as it is an expense

7. Salary paid is reduction of cash and assets and a reduction of Profit and Capital

8. Commission received increases cash or asset, while increasing Profit and Capital

9. Prepaid insurance is an addition to asset, and an increase in Profit and Capital

10. Accrued interest is an addition to asset and an increase in Profit and Capital

11. Advance interest received is a Liability as it is not yet due, but as an income it is added to Assets

Equation Table:

CBSE Class 9 Elements of Book-Keeping and Accountancy Unit 2: Accounting Equation Effects – Completed

We have completed the following topics in this unit:

Content:

Business Entity Concept

Dual Aspect of the Transaction and the Accounting Equation

Effect of Transactions on Accounting Equation

Learning Outcomes:

Understand the importance of Business Entity concept

Explain the concept of accounting equation

Appreciate that every transaction affects the accounting equation