Content:

Definition and importance of Ledger

Relation between journal and ledger

Meaning of Posting – rules and procedure of posting transactions from journal to ledger

Balancing of Accounts

Learning Outcomes:

Concept of ledger and its importance in accounting process

Appreciating relationship between journal and ledger

Understanding the process of posting transactions and balancing accounts

Meaning of Ledger posting clarified

Understanding Procedure of Ledger Posting

The Concept of Ledger:

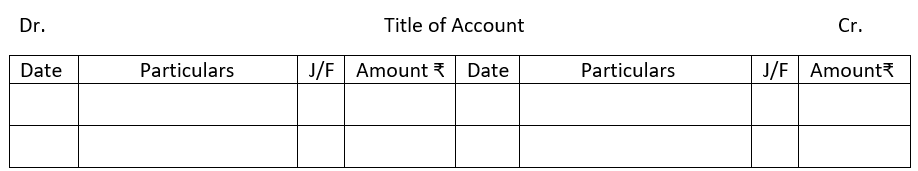

The Ledger is the principal book of Accounts. According to William Pickles ‘Ledger is the destination of the entries made in the subsidiary books or journal. While journal emphasises duality of each transaction, the ledger is more specific as it deals with individual accounts and is called the book of final entry. The net result of all transactions in respect of a particular account on a given date can be ascertained only from ledger. In its simplest form a ledger account looks like the English letter “T” the left-side being debit and right-side showing credit accounts. The usual format of the Ledger is shown below:

Ledger format explained:

Title of Account: Name of the Account which ends with the suffix A/C

Dr./Cr.: Dr. means debit side of the Account i.e. Left side

Cr. means credit side of the Account i.e. Right side

Particulars: Name of the Account with reference to the original book entry (journal entry) is written on the debit/credit side of the Account.

Date: Year, Month and date of transaction

J/F or journal folio: The Journal Folio no.is recorded in ledger account where the relevant transaction has been posted.

Importance of Ledger:

The ledger is the principal book of accounts in any business organisation and is of utmost importance. The following points will elaborate on this:

1. The net results of all transactions in respect of a particular account on a given date can only be ascertained from ledger. This paves the way to preparing the final accounts.

2. Values of Sales, Return Inwards, Purchase and Return Outwards can be ascertained from ledger accounts. These accounts are then analysed to take effective steps for better results.

3. With the ledger accounts showing net balance, monitoring debtors and creditors become easier.

4. Book values of assets like Land & Building, Plant & Machinery, Furniture etc., can be ascertained as separate accounts are maintained for each one of them.

5. Cash and Bank balances can be ascertained on any day through Cash Book which is basically a ledger account sometimes called a journalised ledger.

Relationship between Journal and Ledger:

1. Inter-dependence: Journal is the record of occurrence of a transaction while providing ledger with classified data. It is independent of ledger while ledger is based on journal.

2. Source to destination: Journal makes transaction evidence like bills and vouchers available so that ledger accounts remain clutter free and present a compact picture of the accounts

3. Classification of Accounts: The primary function of Journal is to identify and classify transactions into debit and credit according to rules. Ledger Accounts are built upon such classification.

4. Linked folios: In the format of Journal entries, the Ledger folio no. (L/F) is mentioned and in the Ledger Accounts Journal Folio (J/F) is given. The two complement each other for verification purpose.

Differences between Journal and Ledger:

1. Data Base:

Journal entries are made from various source documents while ledger accounts are posted from journal entries.

2. Prime and Final Entry:

Journal is the book of prime entry as transactions are first recorded here. Ledger is the destination of journal entries and called the Book of final entry.

2. Recording Order:

Journal entries are made chronologically but ledger accounts are grouped accounts where the date of posting is mentioned.

3. Folio:

Ledger Folio numbers are mentioned in Journal while the Ledger records Journal folio for cross reference.

4. Narration:

Narration, which is a brief description of the transaction, is written at the end of each journal entry. No such narration is given in the ledger.

5. Format:

The debit and credit columns of journal are adjacent to each other while the format of the ledger looks like the English letter “T” where the left side is debit side and the right side is for credit postings.

6. Balance:

Journal entries are not balanced but ledger accounts are always balanced.

7. Final A/C:

Journal cannot work out final accounts i.e., Trading, Profit & Loss and Balance Sheet. Ledger accounts are the source material for drawing up the final accounts.

Ledger Posting:

The process of transferring journal entries to individual accounts is called posting. In other words, posting means grouping of all transactions in respect of a particular account at one place for meaningful conclusion and to further the accounting process. Posting from journal is done periodically as per the requirement of the business. The process of posting from journal to ledger

is explained below:

Step 1. Locate the ledger A/c for posting from journal entry

Step 2. Enter the date of transaction in the date column

Step 3. In the particulars column write name of the account through which it has been debited/credited in the journal.

Step 4. Enter the page number (L/F) of the journal in the folio column of the ledger A/c

Step 5. Enter the relevant amount in the amount column.

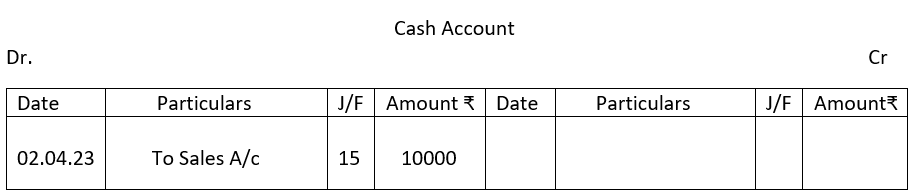

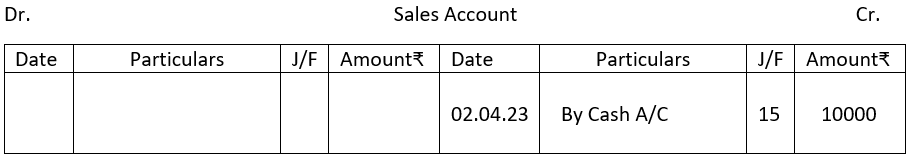

Example:

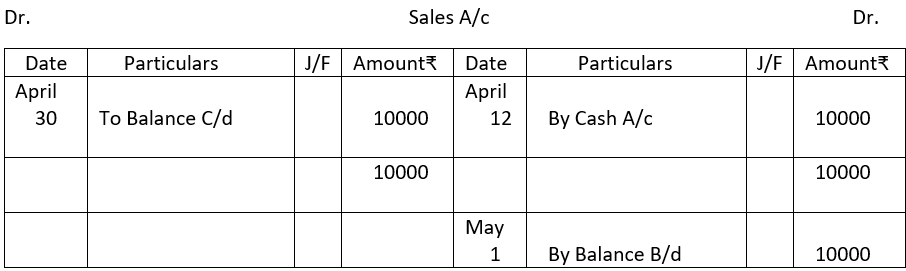

Transaction: Goods sold for Cash ₹ 10000 on 2.4.23

Ledger Posting:

1. Ledger accounts: Cash account and Sales account

2. Date to be entered: 2.4.23

3. Particulars: Cash Sales

4. J/F number: 15 for example

5. Amount: ₹10000

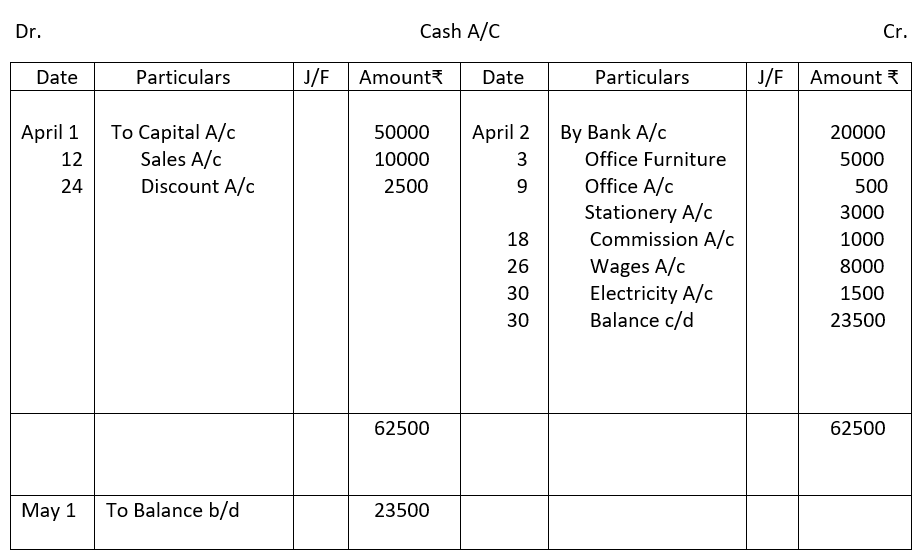

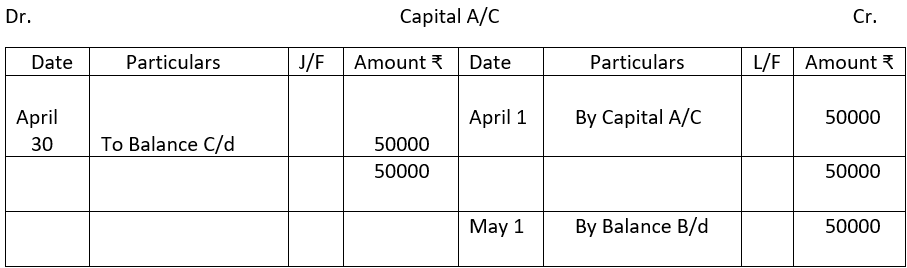

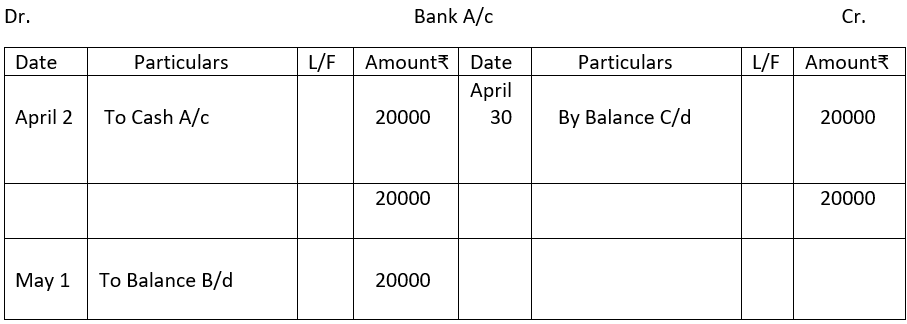

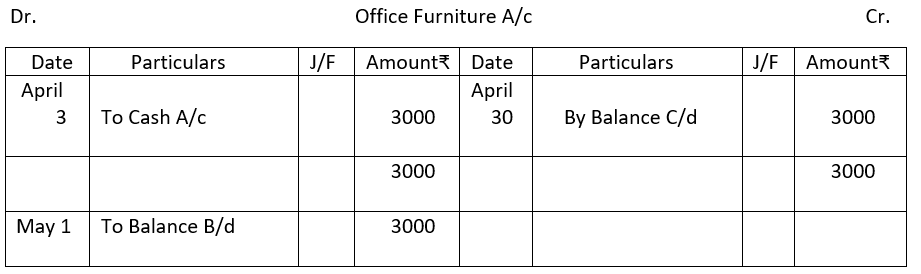

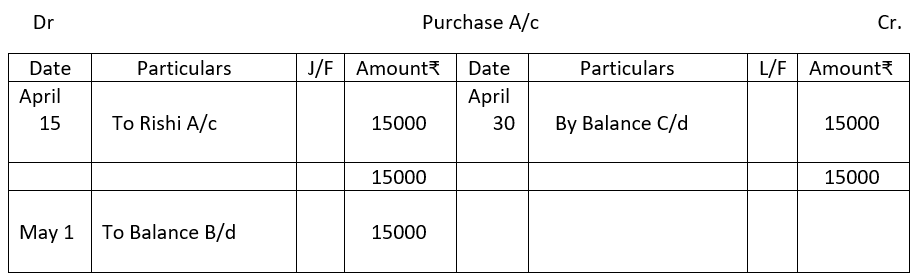

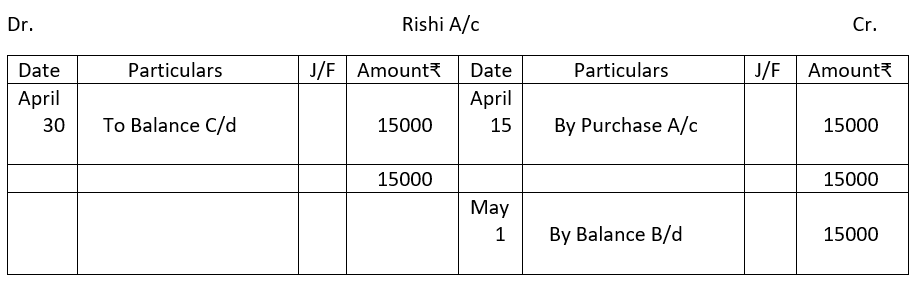

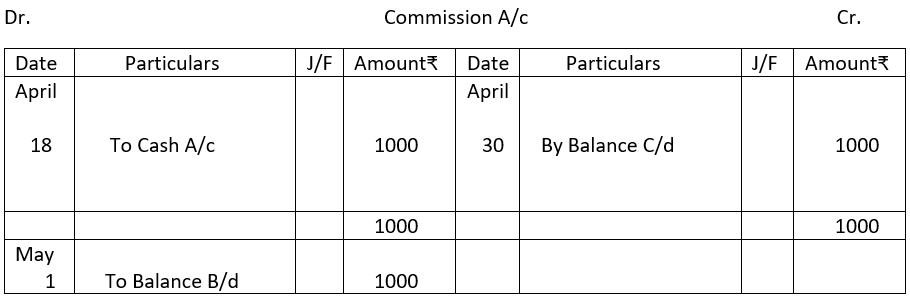

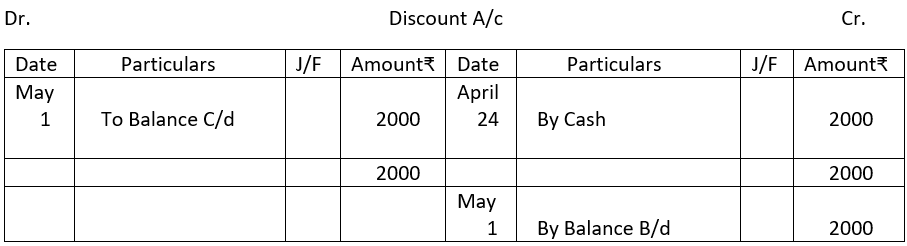

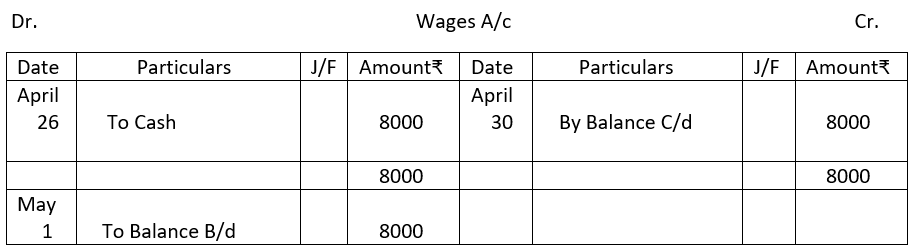

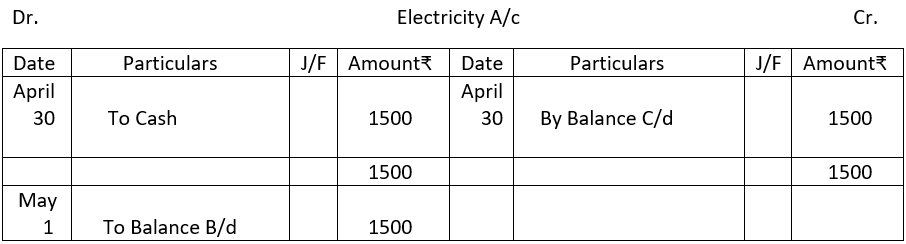

Balancing of Account:

Accounts in the ledger are periodically balanced, generally at the end of the accounting period with the object of ascertaining the net position of each account. Balancing means two sides of an account debit and credit are totalled and the difference between them is found out. This amount is then added to the deficit side to make two sides equal and is written as balance carried down or balance c/d. In the next accounting period this amount is brought over as balance brought down or balance b/d. The process is continued like this till the account is finally settled or closed.

In case the debit side exceeds the credit side, the difference will be written on the credit side and it will be called a debit balance account. If the credit side exceeds the debit side the difference between the two sides will appear on the debit side and it will be called a credit balance account. Simply put, if the debit side is higher it is a debit balance account and if the credit side total is more it will be a credit balance account.

Ledger posting and balancing of accounts from journal entries in in the Books of Dilip & Co.:

Note: Here the debit side is in excess by ₹23500 and this difference amount is carried down on the credit side. So, this cash account is a debit balance account.

CBSE Class 9 Elements of Book-Keeping and Accountancy Unit 5: Ledger – Completed

We have completed the following topics in this unit:

Content:

Definition and importance of Ledger

Relation between journal and ledger

Meaning of Posting – rules and procedure of posting transactions from journal to ledger

Balancing of Accounts

Learning Outcomes:

Concept of ledger and its importance in accounting process

Appreciating relationship between journal and ledger

Understanding the process of posting transactions and balancing accounts

Meaning of Ledger posting clarified

Understanding Procedure of Ledger Posting