Content:

Recording and posting of cash transactions

Necessity of Cash Book and its preparation

Simple Cash Book and Cash Book with Cash and Discount columns

Petty Cash Book and Imprest system

Learning Outcomes:

Understanding the purpose of maintaining a Cash Book

Developing the skill of formatting different types of Cash Book

Understanding the method of recording cash transactions in simple cash book,

double column cash book with cash and discount columns and petty cash book.

Understanding the concept of Imprest System

Developing the skill of maintaining petty cash book on Imprest system

Necessity of maintaining a Cash Book:

Cash Book is used to record transactions relating to cash receipts and payments. It is an extremely important accounting book for any organisation, big or small as cash transactions take place in large numbers and effective control over them is absolutely necessary. Cash book eliminates the need for journal entries as no separate cash or bank account is required because every cash transaction is recorded here. This is necessary for quick, accurate and efficient cash management as well as for easy reference.

Cash Book – a journalised ledger

Cash book is where cash transactions are recorded for the first time and may be called a book of prime entry. But it does not follow the journal format and is actually modelled like a ledger account., It is called a journalised ledger because of the following factors:

1. All cash transactions are recorded for the first time in Cash Book like journal entries but in the ledger format or the “T” format

2. Like journal, Cash book entries record transactions in chronological order

3. As is the case with journal each transaction is posted from Cash Book to respective ledger accounts

4. A brief narration is recorded in Cash Book like journal entries

Cash Book Format:

We will now discuss four types of cash book formats:

1. Single column Cash Book with cash column only

2. Double column Cash Book with cash and bank columns

3. Double column Cash Book with cash and discount columns

4. Petty Cash Book

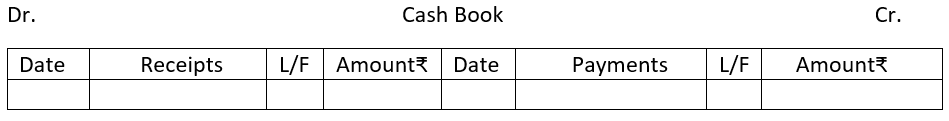

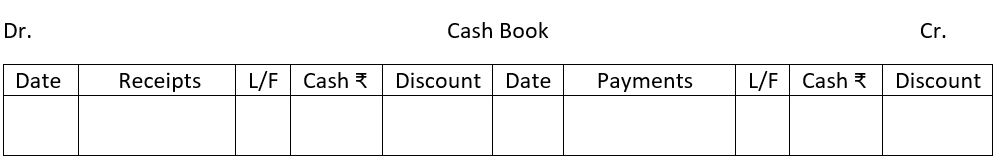

Single column cash book: Format

The single column cash book records all cash transactions i.e., all cash receipts and payments of a business in chronological order. When receipts and payments are made in cash only the cash book will show only one amount column on either side – the debit side showing receipts and the credit side showing payments.

Note: Cash book is a journalised ledger, but it is posted with Ledger Folio or L/F no. and not the Journal Folio or J/F no. for linking the other account of the transaction posted in the ledger to complete double entry.

Example:

Consider the following transactions in the books of in the books of Parthib:

| Date 2023 | Transaction detail | Amount₹ |

| Jan 02 | Started with capital | 50000 |

| Jan 04 | Sold goods for cash | 20000 |

| Jan 08 | Purchased office furniture | 5000 |

| Jan 13 | Purchased stationery | 3000 |

| Jan 17 | Discount received | 2000 |

| Jan 20 | Paid wages | 7000 |

| Jan 22 | Paid Electricity bill | 3000 |

| Jan 24 | Purchased goods | 10000 |

| Jan 27 | Paid rent | 5000 |

| Jan 30 | Paid for petty expenses | 2000 |

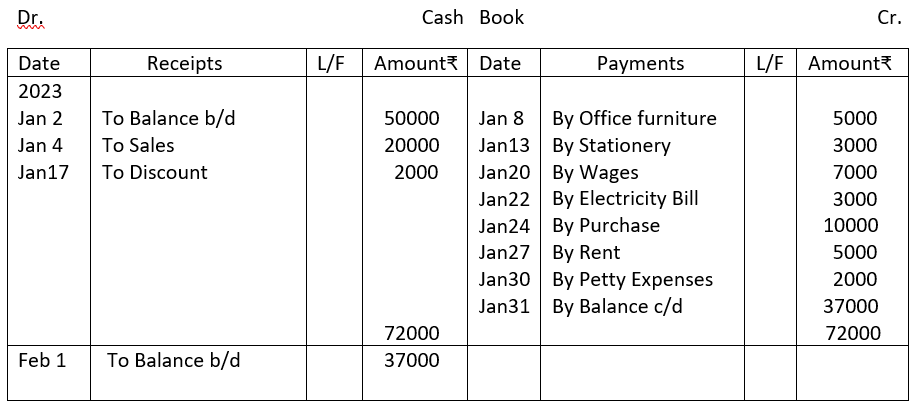

Posting in single column Cash Book in the books of Parthib:

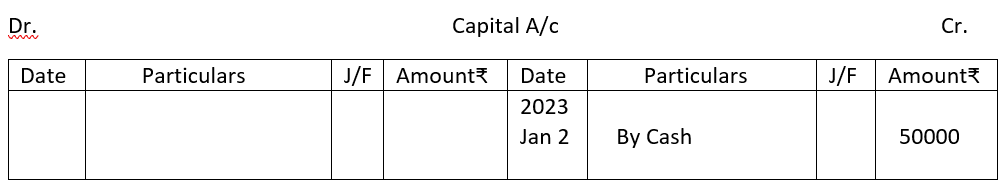

Note: It is evident that left side of the cash book i.e., the debit side records the cash receipts while the right side or the credit side shows payments made in cash. The accounts appearing on the debit side of the cash book are credited in the respective ledger accounts to complete double entry rules. In the above example, Parthib started with ₹50000 cash which was posted on the debit side of the cash book. To complete the transaction capital account will be credited with ₹50000 in the ledger shown below:

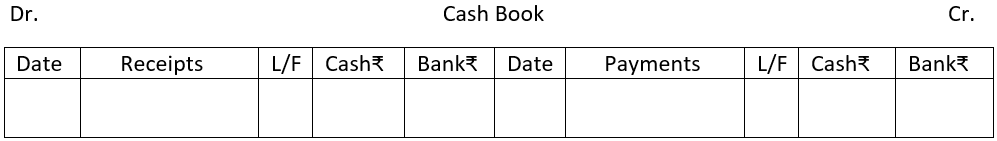

Double Column Cash Book:

This type of cash book has two amount columns on each side – one for cash and the other for bank transactions. A bank account has to be opened in the name of the company. In a modern business most of the receipts and payments are routed through the bank. This is to ensure transparency of operations. Cash and bank transactions can be verified from the same book and a separate bank account is not necessary. For doing bank transactions, opening of a bank current account is necessary.

The important thing here is to enter the bank transactions correctly. Entries in respect of cheques received should be made in the bank column of the cash book. The following points may be noted in this context specially in connection with cheques:

1. Cheque received and deposited same day:

If a cheque is received and deposited into bank on the same day the cheque amount is recorded in the bank column of the cash book on the receipt side.

2. Cheque received but deposited later:

If a cheque received is deposited in bank on a subsequent date, it is treated as deemed cash/cash received on that date and is entered in the cash column of the cash book on the debit/receipt side. On the date of deposit of the cheque in bank the cheque amount will be shown in the Bank column on the Receipt/debit side and then in the cash column on the payment/credit side

3. Cheque received but dishonoured:

Entry has to be made with the cheque amount on credit side of cash book in the bank column. The dishonoured cheque will be returned to the customer. This entry will restore the position prevailing before the receipt of the cheque.

Alternatively:

(i) When a cheque is received the cheque amount can be recorded in the debit side of bank column of the cash book irrespective of the date of presentation in bank.

(ii) If the cheque is honoured no further entry is necessary. But, if the cheque is dishonoured, bank column will have to be credited i.e. a reverse entry has to be passed. This entry will again restore the position of the bank account as it was before the receipt of the cheque.

Format of a double column cash book with Cash and Bank columns:

Format of a double column Cash Book with cash and discount columns:

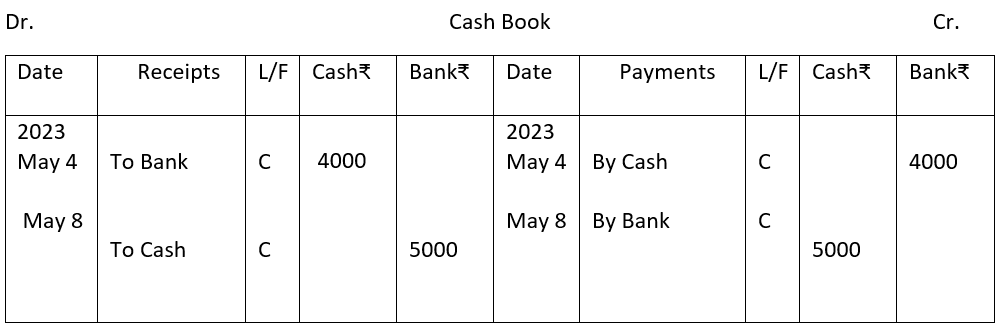

Contra Entry: When a transaction involves both cash and bank accounts they are posted in the cash book itself double column cash book through reverse entries called “contra” entries with the letter “C” written in the L/F column. Let us consider the following transactions involving “Contra” entries:

1. Cash withdrawn from Bank ₹4000 on 4.5.23

Here, cash column of the cash book will be debited as cash is coming in and bank column of the cash book will be credited as bank balance is withdrawn.

2. Cash deposited into bank ₹ 5000 on 8/5.23

Here, Cash goes out to Bank A/c so, it will be credited in the cash column of the Cash Book on payment side. Deposit is coming into bank account, so it will be debited in the bank column on receipt side of the cash book. Cash Book postings will be as follows:

Double column Cash Book with Cash and Bank column

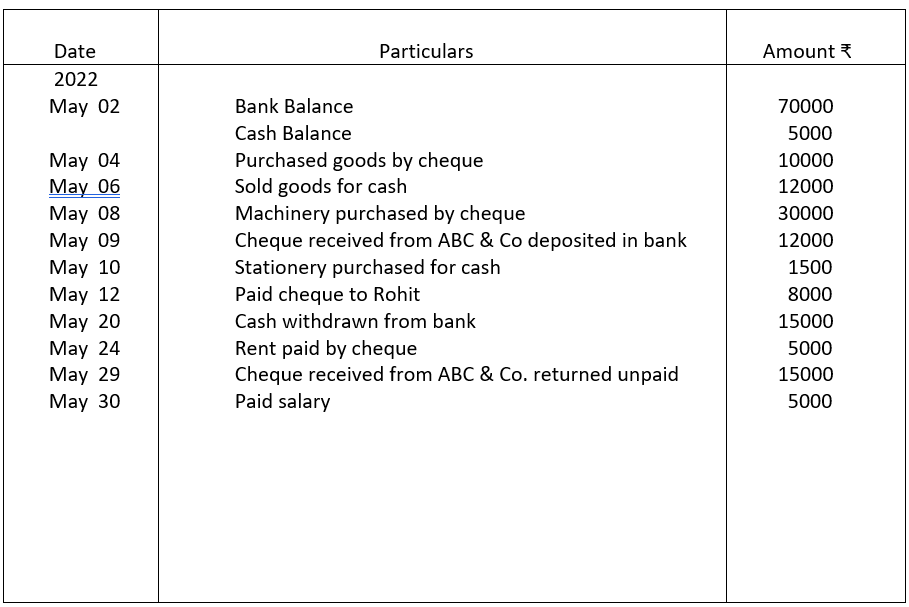

Illustration 1

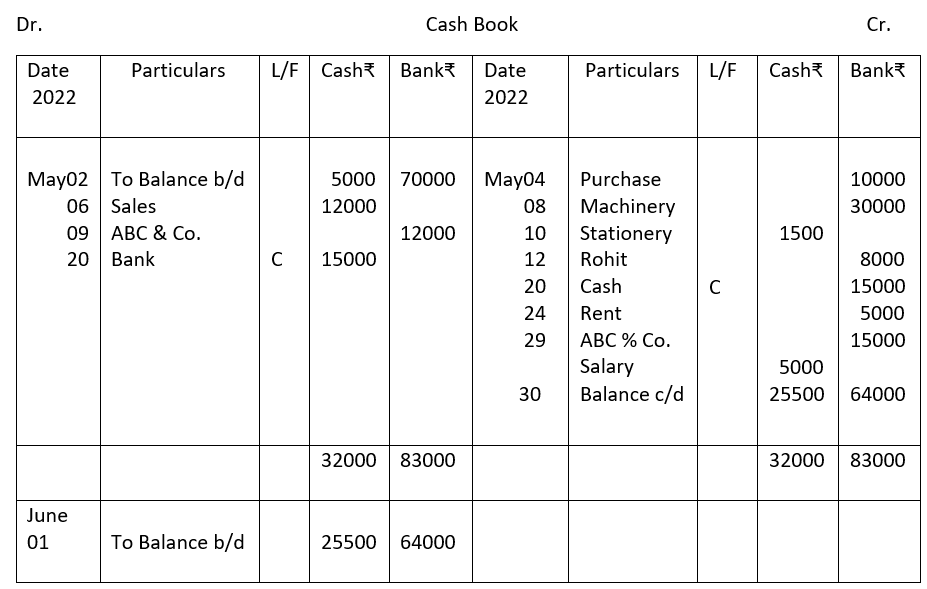

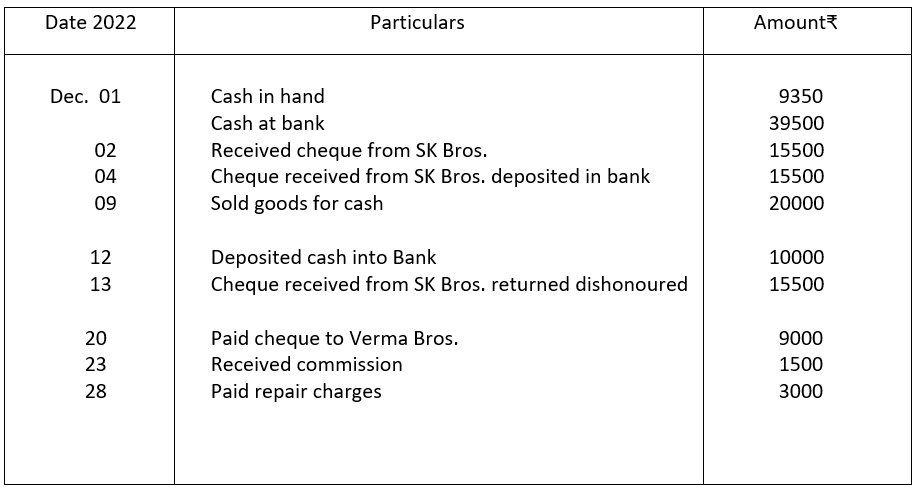

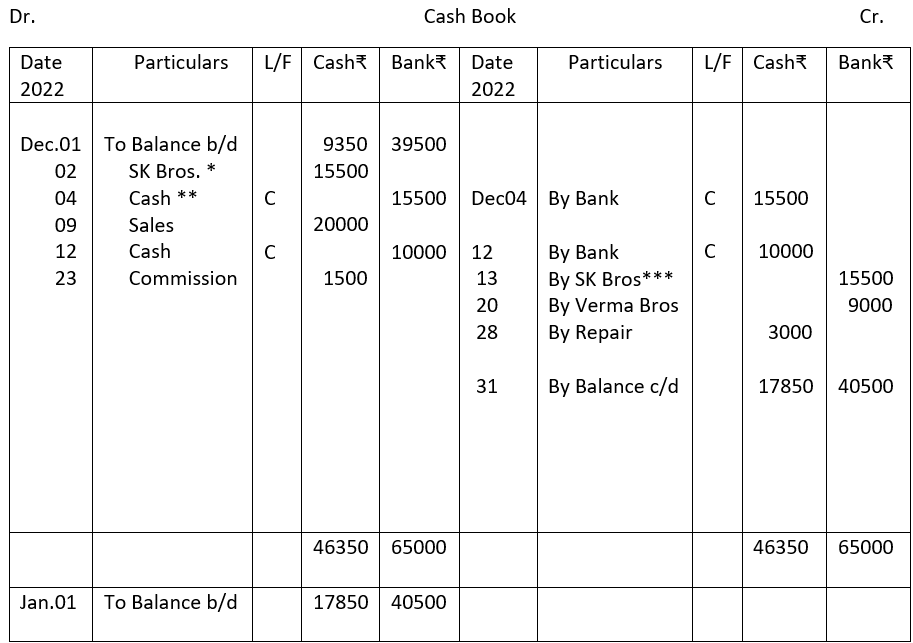

Illustration 2: Prepare a Double column Cash Book with cash and bank columns

*Since the cheque received was not deposited on the same day it was debited in cash a/c

**when the cheque was deposited in bank the bank a/c was debited and cash a/c credited

*** when the cheque was dishonoured bank a/c was credited cancelling the earlier debit

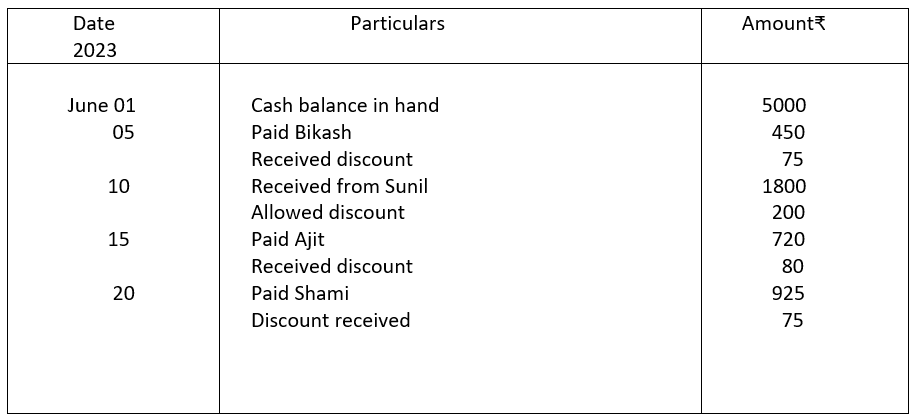

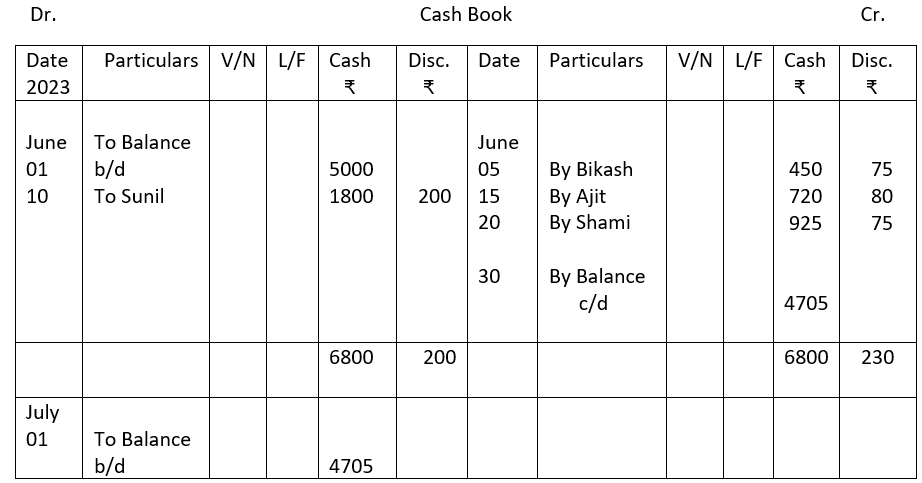

Double Column cash book with cash and discount columns

A cash book with cash and discount columns is a double column cash book to show discount received and discount allowed. The discount column is inserted if transactions involving discounts take place in large numbers. Let us consider the following transactions and post them in Double Column cash book involving cash and discounts.

Illustration 3:

Petty Cash Book:

In any business enterprise a number of small expenses like, conveyance, postage, stationery are incurred every day. These are small recurring expenses are prone to frauds. Therefore, these expenses have to be monitored effectively. The cash book is not usually cluttered with these entries. This is why a separate book called the Petty Cash Book is maintained where all such small payments are recorded.

Advantages of maintaining Petty Cash Book are:

1. Effective control over cash disbursements as the head cashier can keep a check on petty payments through the petty cashier.

2. Saving time and effort of Chief Cashier who can concentrate on large transactions involving cash and bank.

3. Convenience in recording cash transactions as a separate petty cash book keeps the main cash book clutter free and manageable.

Types of Petty Cash book:

There are two types of petty cash book :

1. Simple Petty Cash Book : It has two sides – debit and credit like a single column cash book and one amount column on each side. All cash received from the head cashier are entered on the debit side and all petty expenses on the credit side. The book is like a general cash book but for petty expenses.

2. Analytical Petty Cash Book: When the petty expenses are analysed by allotting separate columns for each type of expenditure, it is called an Analytical Petty Cash book. For example there would be separate columns for travelling, postage, telephone expenses, stationery etc. and each account can be controlled effectively.

Systems adopted for Petty Cash accounting:

Open system: Under this system the cashier gives a fixed sum of money to petty cashier to meet petty expenses. As soon as the fund is exhausted the cashier gives another instalment.

Fixed advance system: Under this system the cashier gives a fixed some of money for a fixed period of time. When the money is exhausted next instalment is given.

The Imprest System: The Imprest System requires a fixed sum of money be given to the petty cashier at the beginning of a certain period. This is called the Imprest cash. The petty cashier goes meeting expenses from this fund and at the end of the period receives the total amount spent so that the Imprest cash balance remains the same. The reimbursement may be made on a weekly, fortnightly or monthly basis.

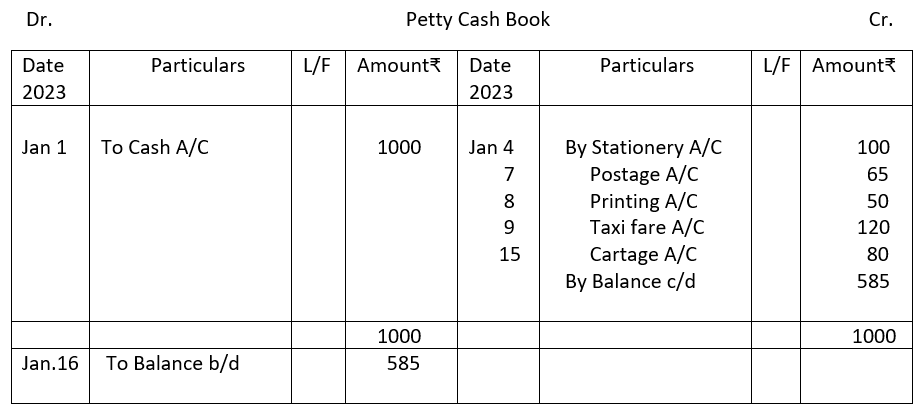

Example of a simple Petty cash book :

Transactions :

| Date 2023 | Particulars | Amount₹ |

| Jan 01 | Received from chief cashier | 1000 |

| Jan 04 | Paid for stationery | 100 |

| Jan 07 | Paid for postage | 65 |

| Jan 08 | Printing Charges | 50 |

| Jan 09 | Paid taxi fare | 120 |

| Jan 15 | Cartage | 80 |

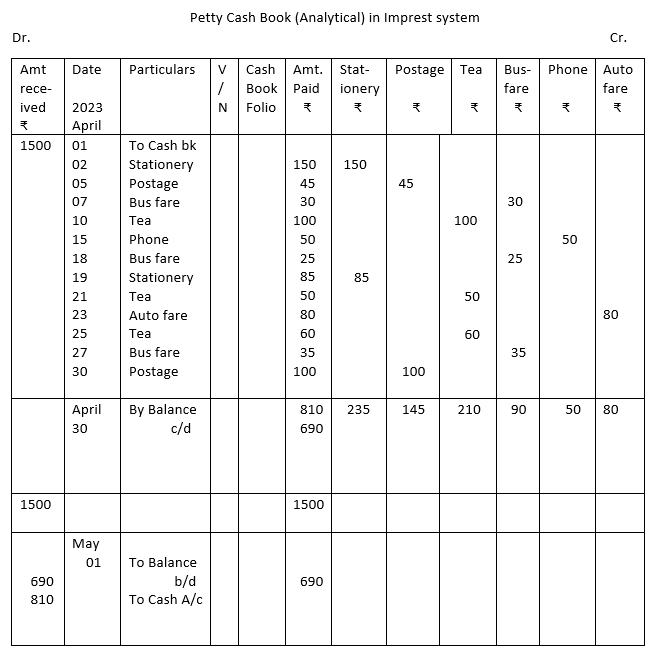

Analytical Petty cash book in Imprest system:

The petty cashier received a sum of ₹ 1500 from the cashier on April 1, 2021 and incurred the following expenses. We will post the transactions in Analytical petty cash book under Imprest where the petty cashier was sanctioned a sum of ₹ 1500 every month.

| Date 2023 | Particulars | Amount₹ |

| April 02 | Purchased stationery | 150 |

| April 05 | Bought postage stamps | 45 |

| April 07 | Paid bus fare | 30 |

| April 10 | Paid tea expenses | 100 |

| April 15 | Phone expenses | 50 |

| April 18 | Paid bus fare | 25 |

| April 19 | Paid for stationery | 85 |

| April 21 | Tea expenses | 50 |

| April 23 | Auto fare | 80 |

| April 25 | Tea expenses | 60 |

| April 27 | Bus fare | 35 |

| April 30 | Postage | 100 |

Explanatory notes:

1. The petty cashier started off with ₹ 1500 on April 1

2. During the month of April he had spent ₹ 810

3. At the end of the month, he was left with a balance of ₹ 690

4 The petty cashier was given a monthly imprest cash balance of ₹ 1500

5. Accordingly, he was given ₹ 810 on May,1 to fulfil the imprest cash balance of ₹ 1500

6. V/N is the voucher number of expenses incurred

CBSE Class 9 Elements of Book-Keeping and Accountancy Unit 6: Recording and posting of cash transactions – Completed

We have completed the following topics in this unit:

Content:

Recordingand posting of cash transactions

Necessity of Cash Book and its preparation

Simple Cash Book and Cash Book with Cash and Discount columns

Petty Cash Book and Imprest system

Learning Outcomes:

Understanding the purpose of maintaining a Cash Book

Developing the skill of formatting different types of Cash Book

Understanding the method of recording cash transactions in simple cash book,

double column cash book with cash and discount columns and petty cash book.

Understanding the concept of Imprest System

Developing the skill of maintaining petty cash book on Imprest system