Content:

Purpose of preparing Trial Balance

Process of preparing Trial Balance

Learning Outcome:

Understanding the need and objective of preparing Trial Balance

Developing the skill of preparing Trial Balance by balance method

We know that under Double Entry system every transaction is first journalised and then posted in the ledger where one account is debited and the other account is credited. So, there will be one debit balance and one credit balance for each transaction. Logically, if we add up the balances on the debit and credit side they must agree. This is done through a statement called the Trial Balance. It is a list of all Ledger Account balances appearing on a given date including cash and bank balance. If the two sides of this statement tally the accounting entries are supposed to be generally accurate.

Purpose of preparing Trial Balance:

The purpose of preparing a trial balance is to achieve the following objectives:

1. To ascertain the arithmetical accuracy of the ledger accounts: Trial Balance is a list of the accounts and their balances. When the totals of the debit and credit balances in the trial balance are equal, it is assumed that ledger posting and balancing are arithmetically correct.

2. To help preparation of financial statements like Profit & Loss account and Balance Sheet:

The availability of a tallied trial balance is the first step in preparation of financial statements like profit & loss account and balance sheet. One need not refer to ledger account balances to do this. This preparation of final accounts convenient.

3. To help locate errors when there is any mismatch. In case of a disagreement in Trial balance the accountants know where to look. (refer to discussion below)

Preparation of Trial Balance:

A Trial Balance can be prepared in the following three ways:

1. Totals Method

2.Balances Method

3.Totals-cum-balances Method

Totals Method: Under this method the totals of each side of the ledger accounts (debit and credit) are shown in two columns of the trial balance. One of the drawbacks of this system is that it does not ensure accuracy of the balances in different ledger accounts.

Balances Method:

Most widely used method of preparing a trial balance, this is an effective tool of testing the accuracy of the accounts. Under this method the statement of trial balance showing all the balances of the ledger accounts, debit and credit is drawn up and then totalled. The agreement of the two sides normally ensures correctness of the accounting process.

Totals-cum-balances method: This method is a combination of totals method and balances method. Under this method four amount columns are prepared. Two columns are for writing debit and credit totals of various accounts. Other two columns are for debit and credit ledger balances. This method is not used in practice because it is time consuming.

Detection of errors in Trial Balance

It is important for an accountant that trial balance should tally as it proves the fundamental accuracy of the accounting process. Any disagreement means there are errors. When the debit and credit sides of the trial balance do not tally it may be concluded that errors must have crept in. The error or errors must have occurred at one of the stages of the accounting process. Such errors may have taken place in:

1. error in casting of subsidiary books

2. posting of journal entries in the ledger

3. error in showing wrong account balances

4. error of posting a wrong amount which will show a wrong account balance

5. If an amount is posted twice in an account

6. omission of account balance in the trial balance

7. If casting of subsidiary (totalling) books is wrong

8. totalling of the trial balance columns.

9. error in recording a transaction in subsidiary book with wrong name or amount

10. error of posting an account in the wrong side resulting in wrong account balance

Limitations of trial balance:

The limitations of the Trial Balance are the errors in accounting process classified as follows:

1. Error of Commission: These are wrong posting of transactions, wrong totalling or wrong balancing of accounts and wrong recording of amount in the Books of Original entry. However, most of the errors of commission affect the Trial Balance

2. Error of Omission: This happens when a transaction is not entered at all in the books of original entry and not posted in the ledger the trial balance will fail to detect it.

3. Error of Principle: This type of error takes place by not following accounting rules and remain undetected in trial balance. It is like debiting purchase account instead of furniture account when furniture is bought. The Trial balance will agree in spite of this error.

4. Compensating error: This happens when one error is compensated by another error. For example, cash paid to Navin ₹1000 is debited to his account as ₹900 thus ₹100 less is debited. Now, while receiving ₹500 from Amit his account is wrongly credited with ₹400. So, a deficit in debit balance is compensated by a deficit of ₹100 in credit balance leading trial balance to agree. But there will be mistake in both debit and credit balances.

Searching errors in Trial Balance – some steps:

If the Trial Balance does not tally, the following steps should be taken to detect the errors:

1. Recast the totals of debit and credit sides of trial balance

2. Compare the account title and amount appearing in the trial balance with that of ledger to detect any difference or omission of an account

3. Re-do and check correctness of individual account balances in the ledger

4. Re-check posting of accounts from the books of original entry

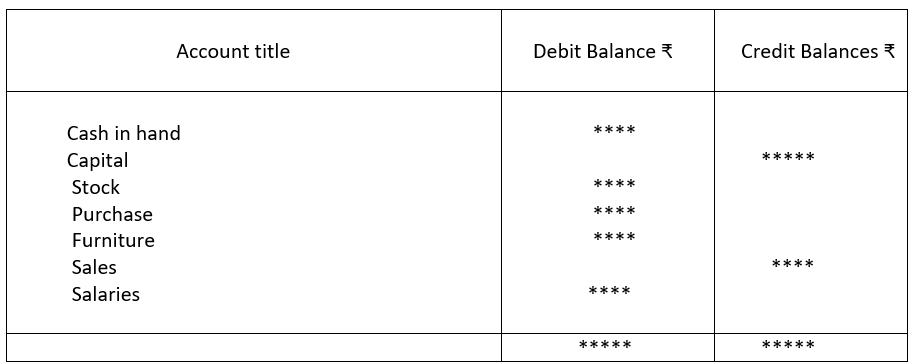

Illustrative format of a Trial Balance:

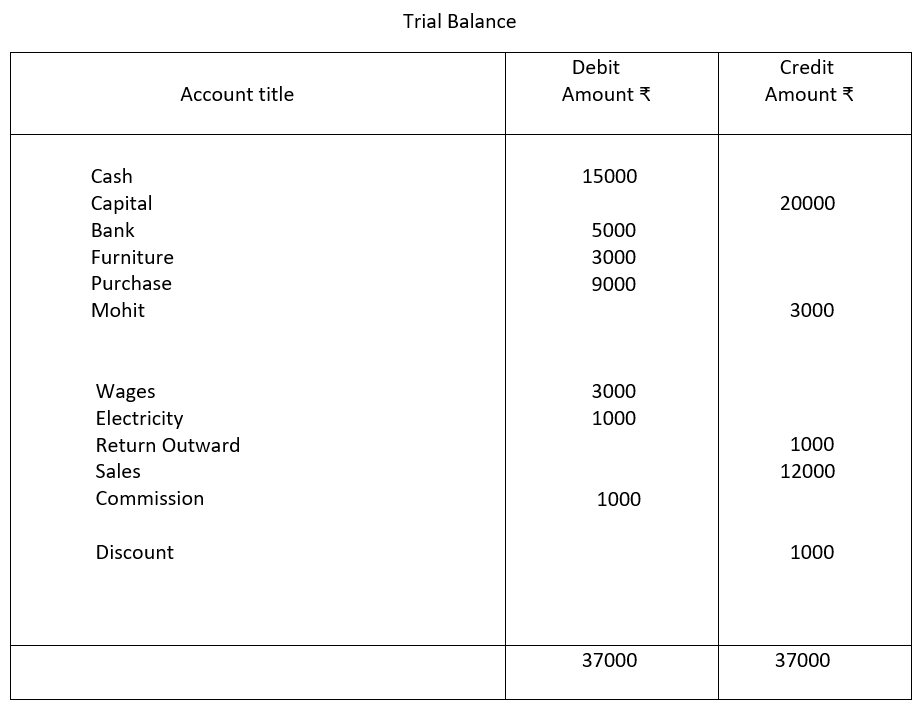

Preparation of Trial Balance: Balance Method

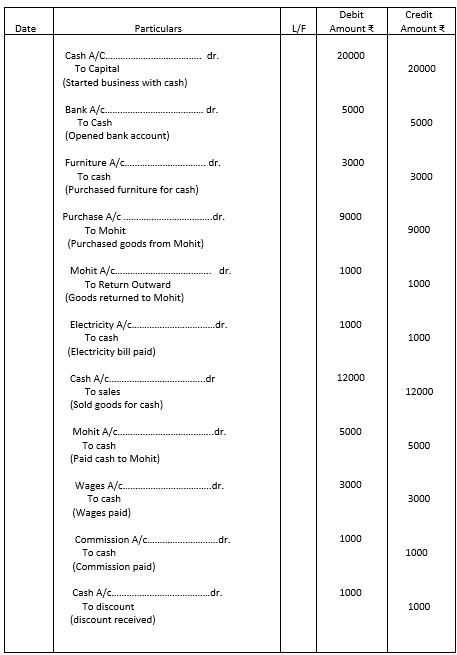

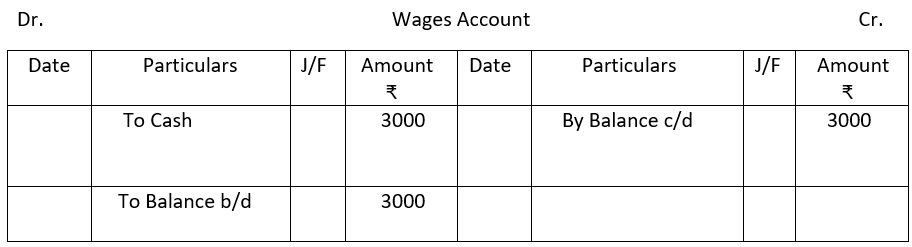

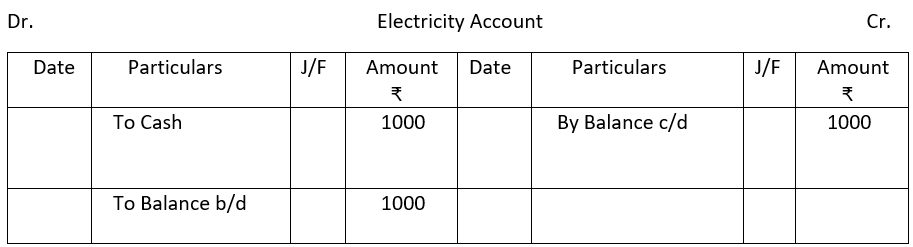

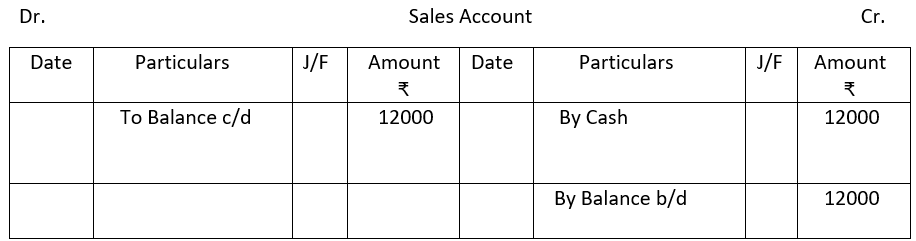

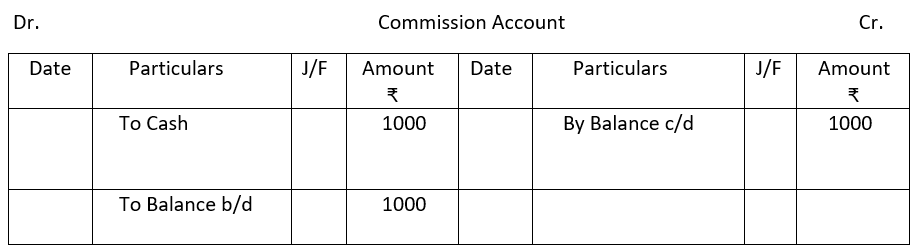

We will now proceed to journalise the transactions noted below, post them in respective ledger accounts and draw up a trial balance to test the arithmetical accuracy of the accounting process:

| Particulars | Amount ₹ |

| Started business with cash | 20000 |

| Opened Bank Account | 5000 |

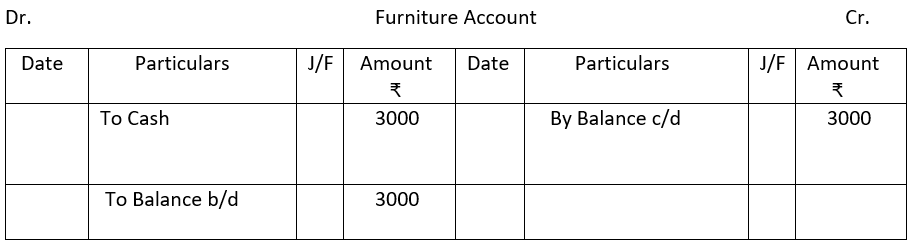

| Purchased furniture in cash | 3000 |

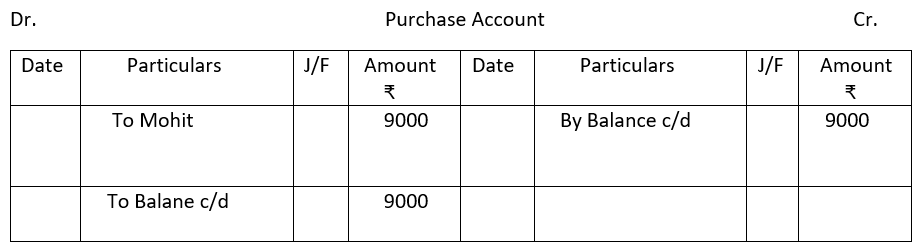

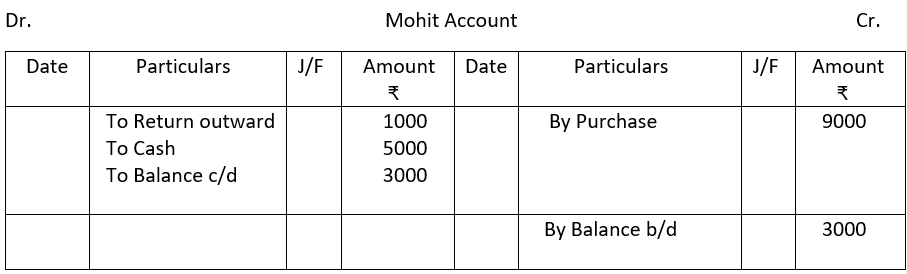

| Purchased goods from Mohit | 9000 |

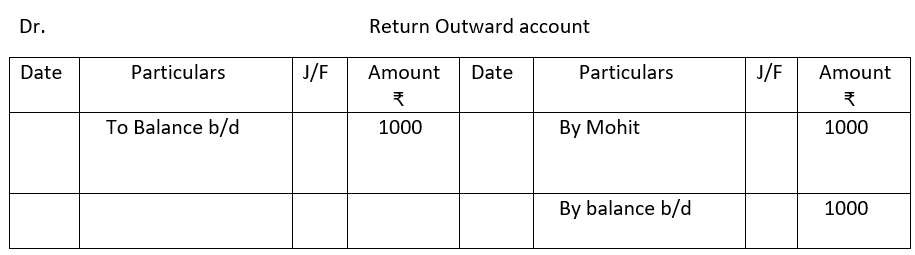

| Returned goods to Mohit | 1000 |

| Paid electricity bill | 1000 |

| Sold goods for cash | 12000 |

| Paid Mohit cash | 5000 |

| Wages paid | 3000 |

| Commission paid | 1000 |

| Discount received | 1000 |

Journal Entries:

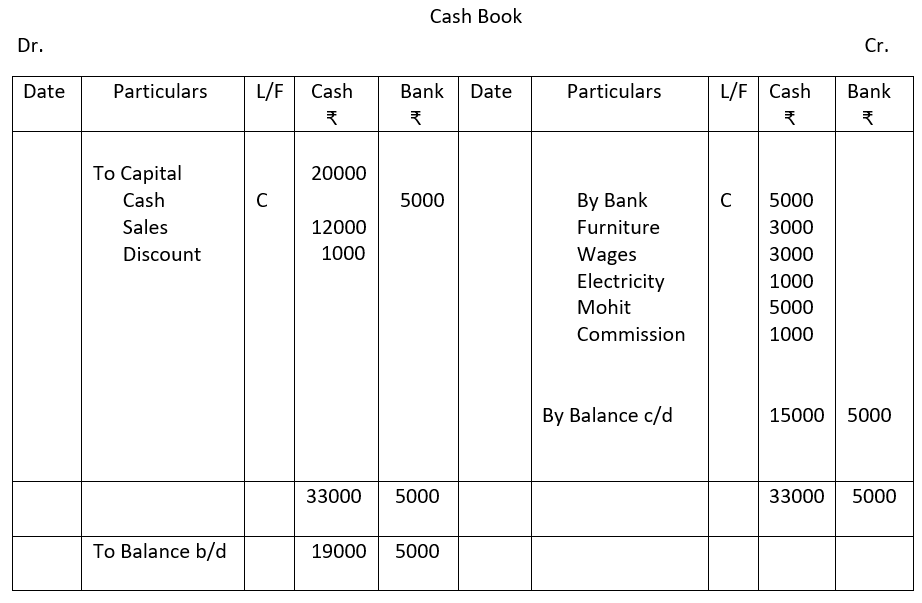

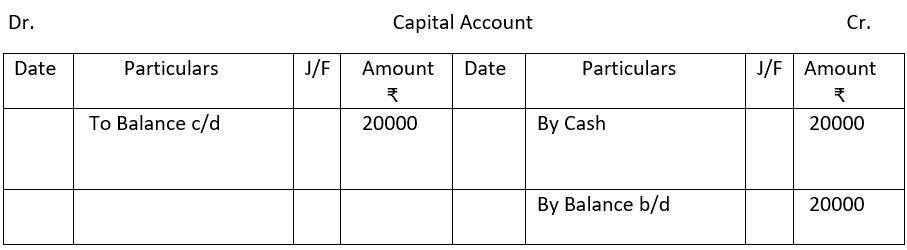

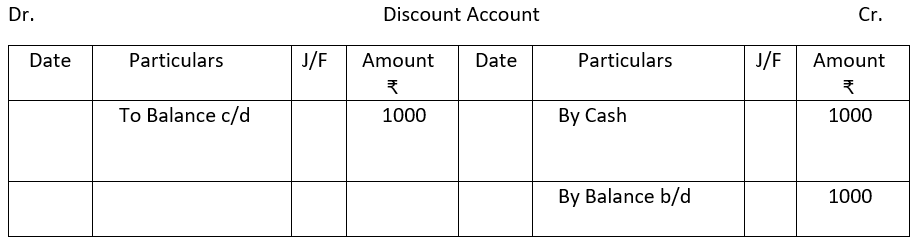

Ledger Posting:

Quick Summary

1. Double entry system of book keeping: Every transaction involves give and take aspect. So, in double entry book keeping every transaction is recorded in at least two places/accounts, debit and credit. In its simplest form an account looks like the English letter “T” where the left and right sides of the “T” are used to record increases or decreases in an account.

2. Meaning of source documents: Various business documents such as invoice, bills, cash memos, vouchers which form the basis of evidence of a business transaction recorded in the books of account are called source documents.

3. Meaning of accounting equation: A statement of equality between debits and credits signifying that the assets of a business are always equal to the total of liabilities and capital.

4. Accounting Equation: Accounting equation signifies that assets of a business are always equal to the liabilities and capital (Owner’s equity). It is expressed in the form of an equation:

Assets = Liabilities + Capital.

5. Under modern system Accounts are of five types:

a) Assets b) Liabilities c) Capital d) Revenue/Gains e) Expenses/Losses

6. Rules of debit and credit: An account is divided into two sides. The left side of an account is known as debit and the right side is credit. The rules of debit and credit depend on the nature of the account. Debit and Credit both represent either increase or decrease. Depending again on the nature of an account. These rules are summarised as follows:

| a) Assets | Debit Increase | Credit Decrease |

| b) Liabilities | Debit Decrease | Credit Increase |

| c) Capital | Debit Decrease | Credit Increase |

| d) Revenues | Debit Decrease | Credit Increase |

| e) Expenses | Debit Increase | Credit Decrease |

7. Books of Original Entry: The transactions are first recorded in this book in a chronological order. Journal is one of the books of original entry. The process of recording entries in the Journal is called journalising.

8. Ledger: A book containing all accounts to which entries are transferred from the books of original entry. ‘Posting’ is the process of transferring entries from the books of original entry to the ledger.

9. Cash Book: Cash Book is used to record cash receipts and payments as well as Bank receipts and payments. Columns indicating discount received and allowed may also be included in cash book.

10. Petty Cash Book: A book used to record small cash payments

11. Purchase journal: A special journal in which all credit purchases are recorded

12. Sales journal: A special journal in which all credit sales are recorded

13. Purchase Return Book: A book in which return of merchandise purchased is recorded

14. Sales Return Book: A book in which return of merchandise sold is recorded

15. Trial Balance: This is a statement showing all debit and credit balances recoded in the ledge with a view to verifying the arithmetical accuracy of postings in the ledger accounts. As per rule of double entry book keeping the two sides should agree to ensure this.

CBSE Class 9 Elements of Book-Keeping and Accountancy Unit 7: Trial Balance – Completed

We have completed the following topics in this unit:

Content:

Purpose of preparing Trial Balance

Process of preparing Trial Balance

Learning Outcome:

Understanding the need and objective of preparing Trial Balance

Developing the skill of preparing Trial Balance by balance method